In this blog post, we’ll delve into the reasons why North Gaia Condo remains relevant and retains its investment potential in Singapore.

Slow Sales

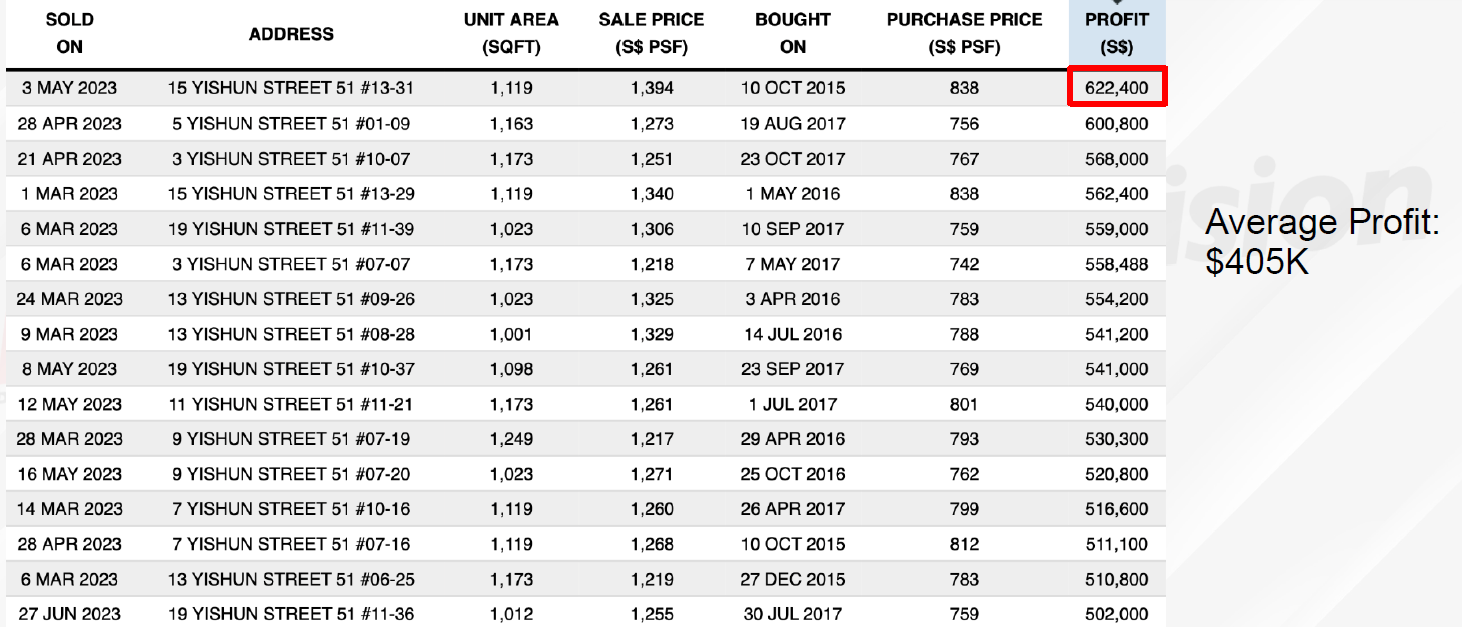

Slow sales at North Gaia, one of the EC projects in Singapore, may not be the concern that some potential homebuyers fear. To put this in perspective, let’s look back at the history of EC developments. Take The Criterion in Yishun, for example. It began selling units in October 2015, with just 41 out of 505 units sold in the first month, and at a median price of S$805 per square foot. However, fast forward to 2023, and the picture is quite different. The average profit for homeowners is around $405,000, with the highest profits reaching an impressive $622,000. So, does the slow sales pace at North Gaia signify a problem for future homeowners? Not necessarily. The history of EC projects in Singapore shows that initial sales figures don’t always reflect the long-term investment potential and profitability for homeowners.

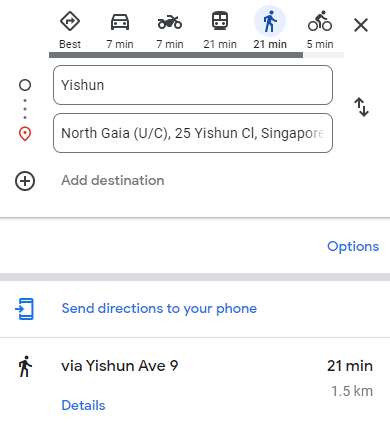

Distance to MRT

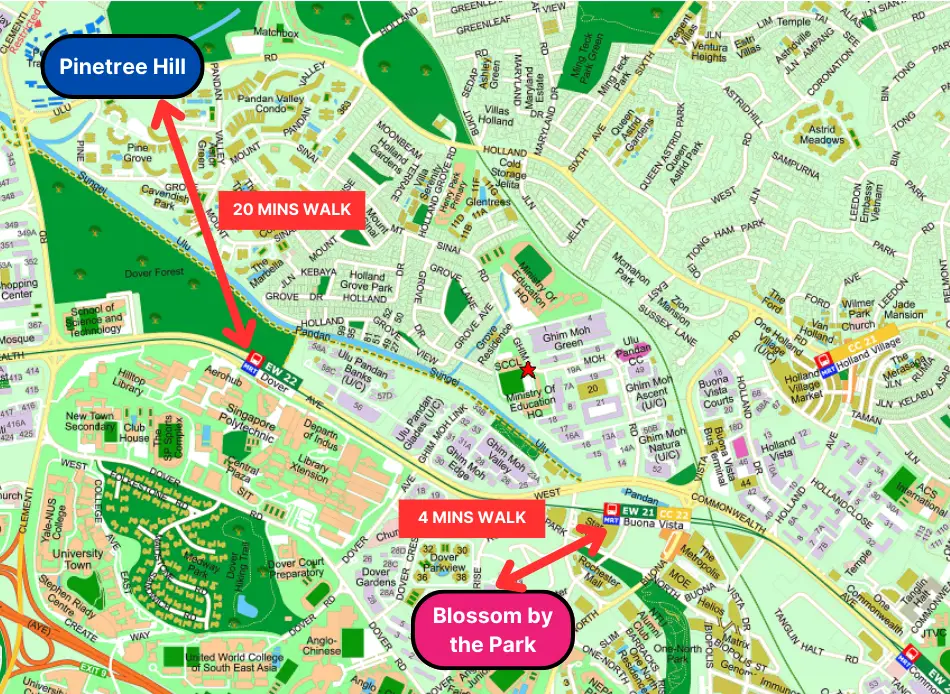

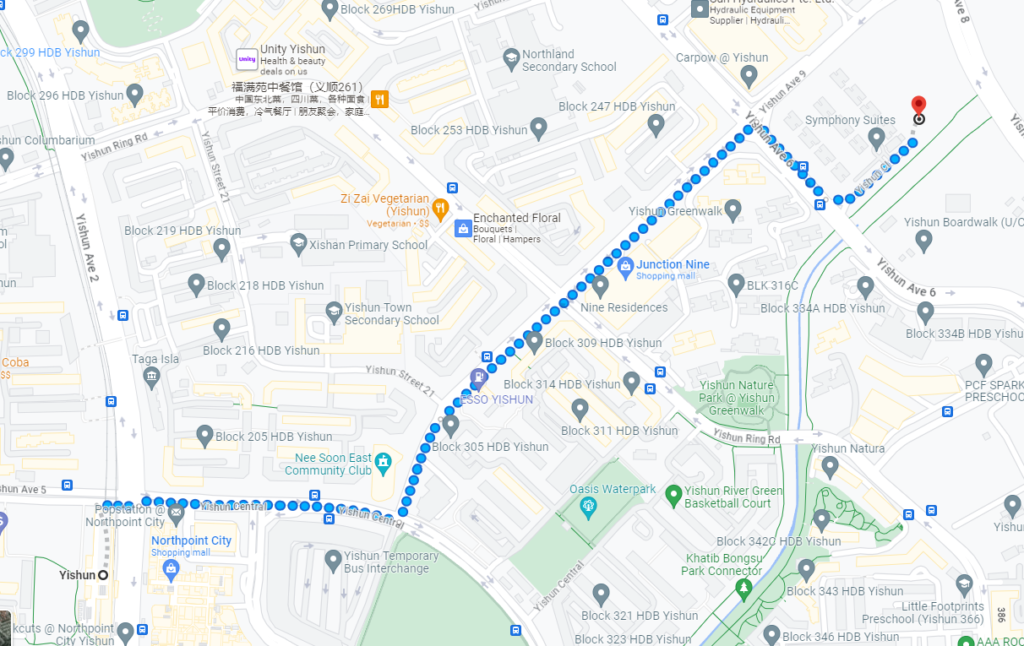

The distance of North Gaia from the nearest Yishun MRT station, being a 20-minute walk or approximately 1.5 kilometers away, may raise concerns among some future homebuyers. However, it’s important to note that this distance alone doesn’t necessarily mean that the value of the property is not there.

Lets take a look at past histories.

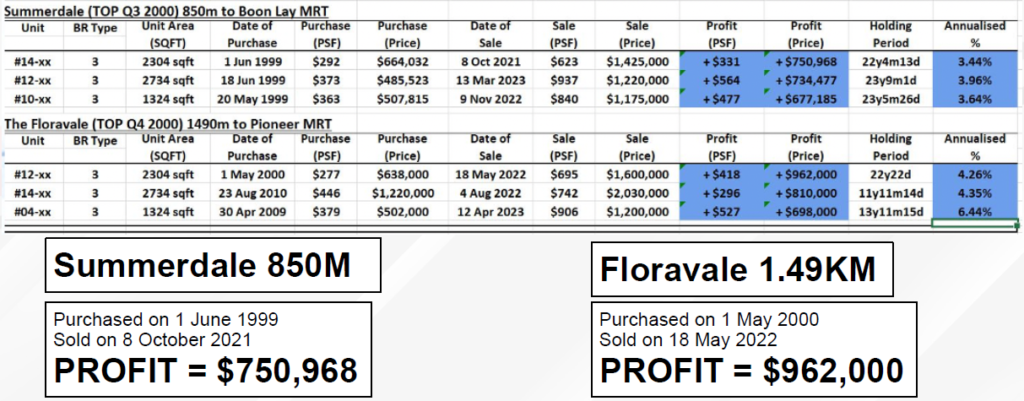

Summerdale VS The Floravale

Summerdale is situated 820 meters from Boon Lay MRT, while The Floravale is 1490 meters away from Pioneer MRT. Given the common belief that MRT proximity significantly impacts profitability, it’s important to examine their transaction data.

The transaction data reveals a staggering disparity in profits, amounting to a whopping $211,032.

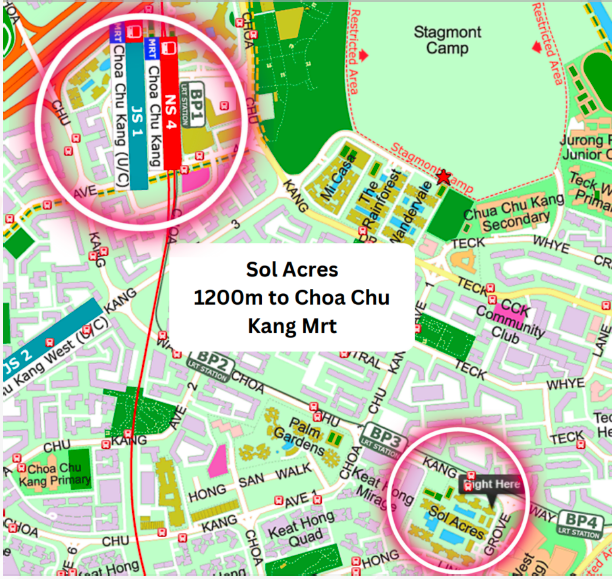

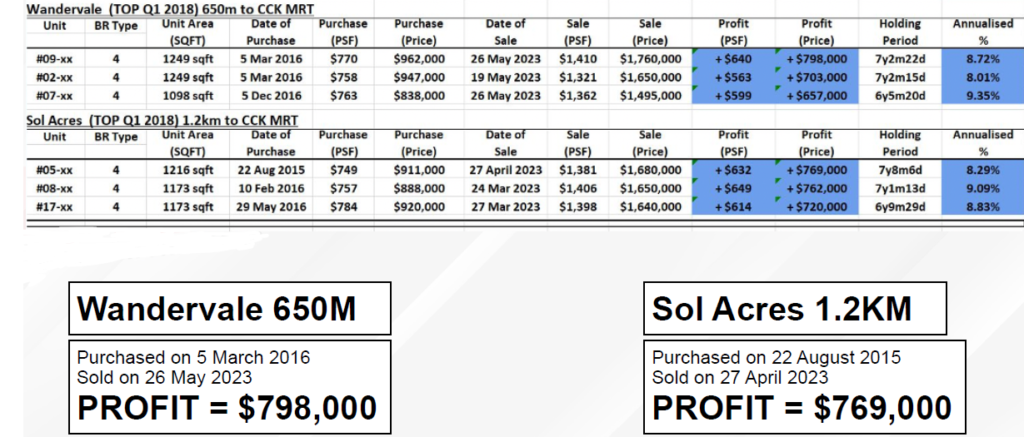

Another one is Wandervale Vs Sol Acres

Wandervale is 650m to Choa Chu Kang MRT while Sol Acres is 1.2km to the same MRT. Again, by belief, Wandervale should be more profitable.

Lets take a look at its transaction data. They, in fact, achieved similar profit margin.

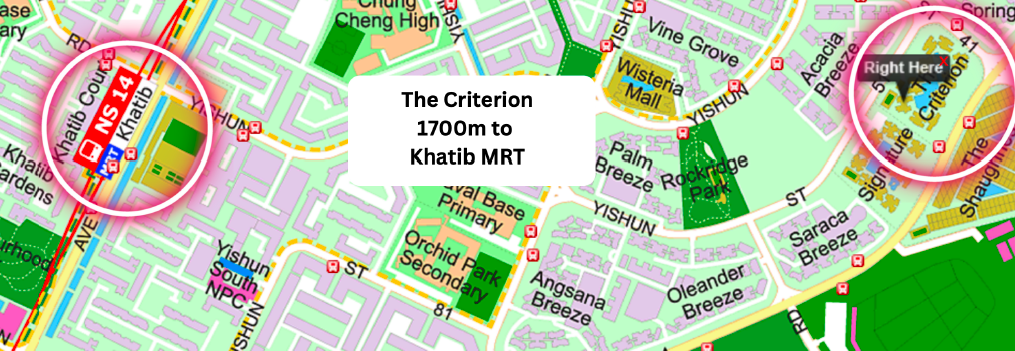

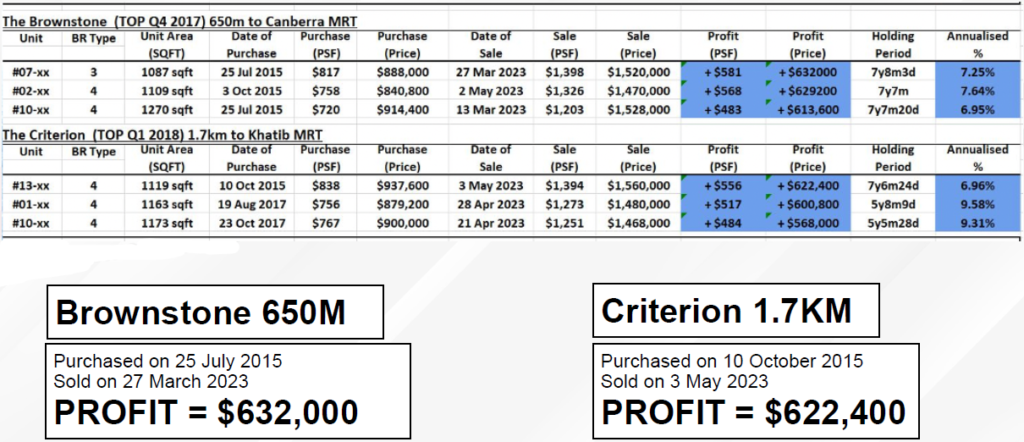

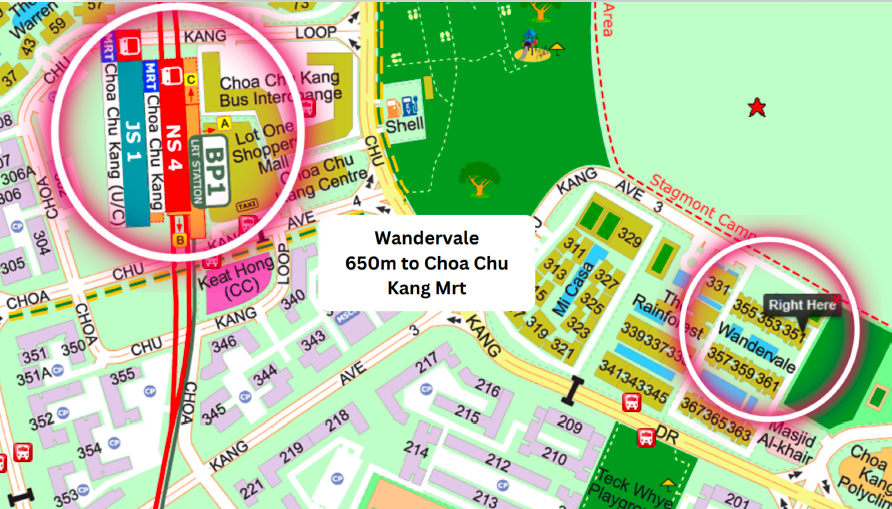

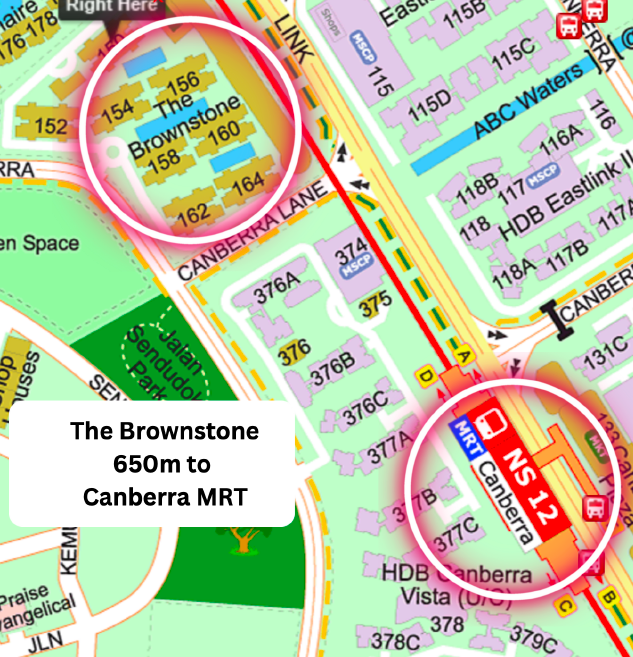

Brownstone VS The Criterion

650m vs 1.7km!

Again, same PROFIT!

In conclusion, the transaction data clearly illustrates that MRT distance is not inherently correlated with profitability. Despite variations in proximity to MRT stations, the evidence shows that the profit margins achieved can be remarkably similar.

Surrounding BTO supply

Does the presence of BTO (Build-to-Order) developments in your vicinity influences your exit strategy? The answer is YES. Big YES!

WHY?

This is because your potential buyers, often HDB upgraders, look for properties in their neighborhood for affordability. To understand this better, let’s examine past data in other areas.

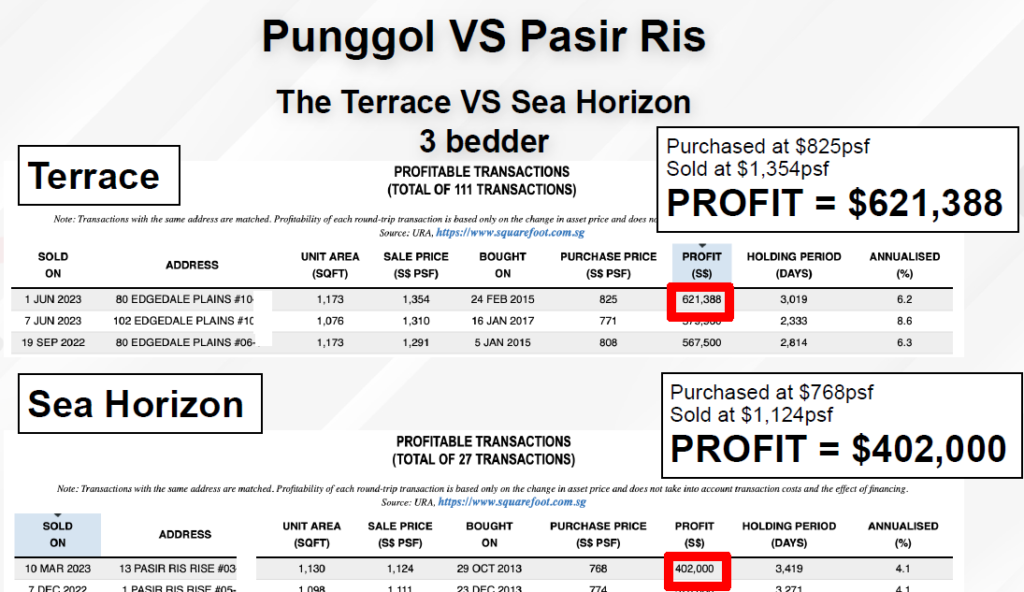

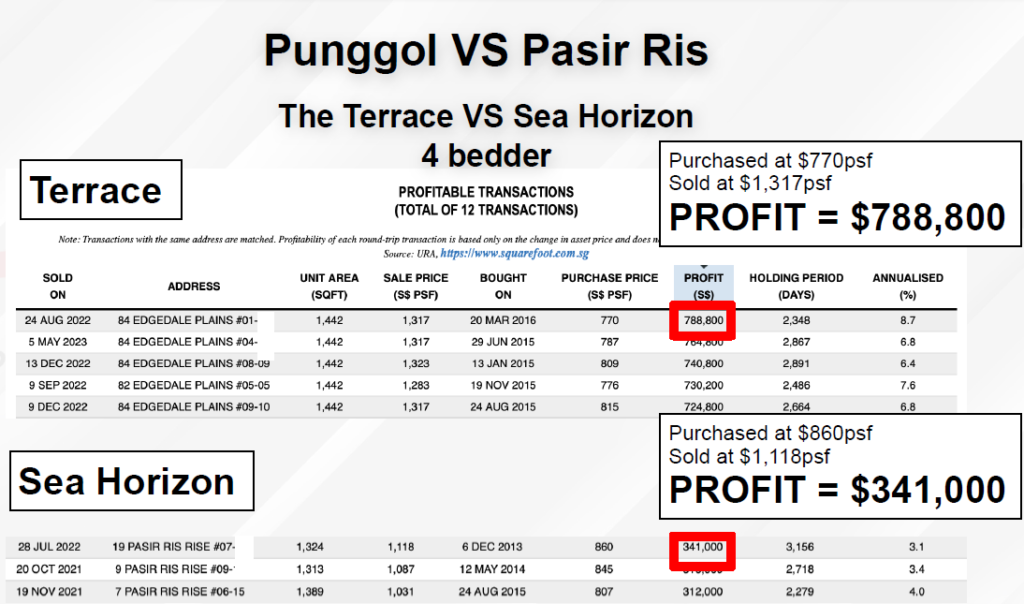

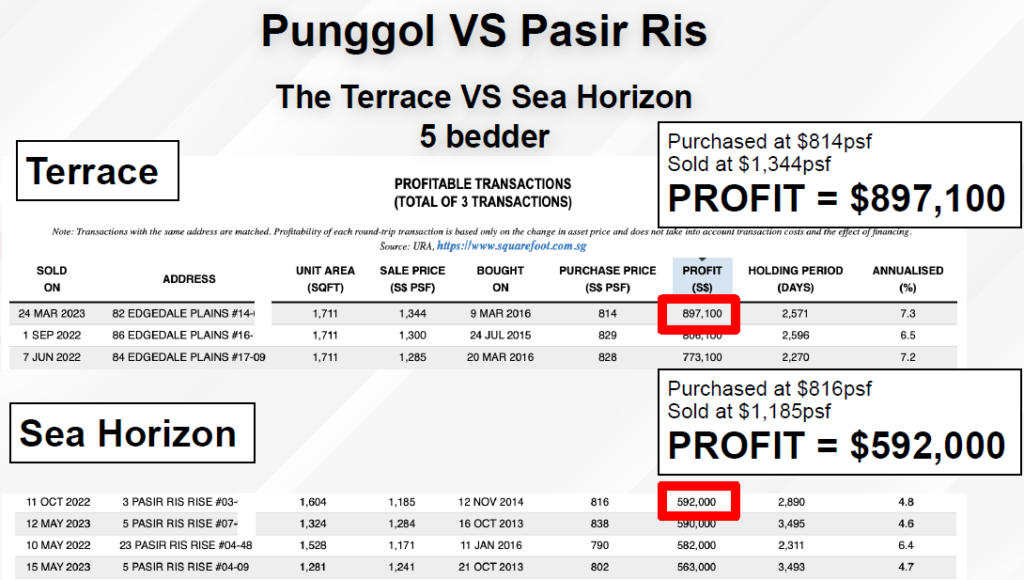

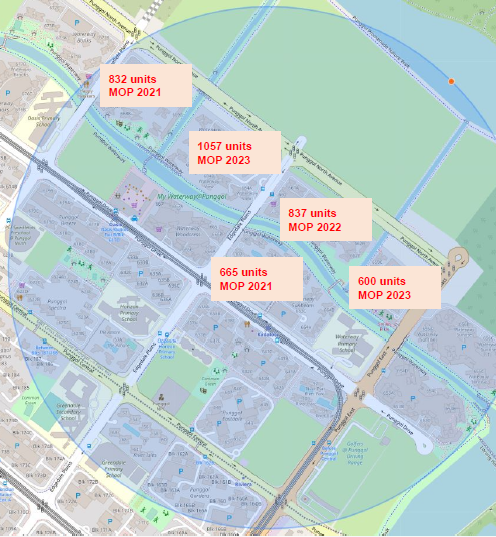

The Terrace (Punggol) VS Sea Horizon (Pasir Ris)

Sea Horizon is surrounded by a complete absence of BTO supply, whereas The Terrace is practically engulfed by nearly 4000 BTO units!

Look at the difference in profit margin! So when you look at this, do you think your exit strategy for North Gaia is quite safe?

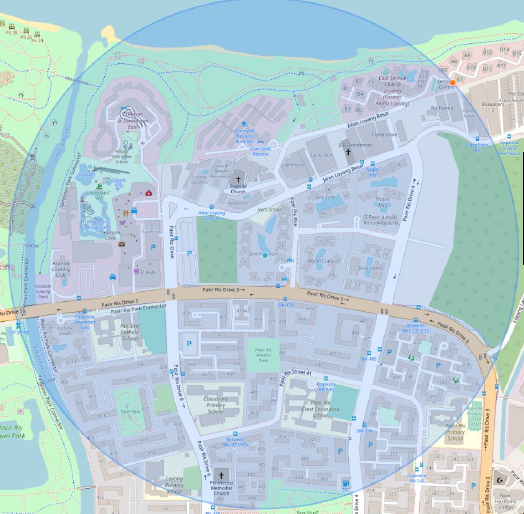

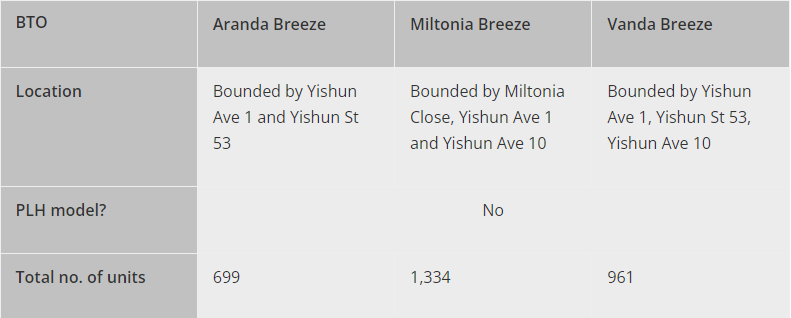

Lets take a look at the upcoming BTO in North Gaia.

There is a total of close to 3000 BTO units that is going to be completed in 2028-2029. These are your potential buyers!

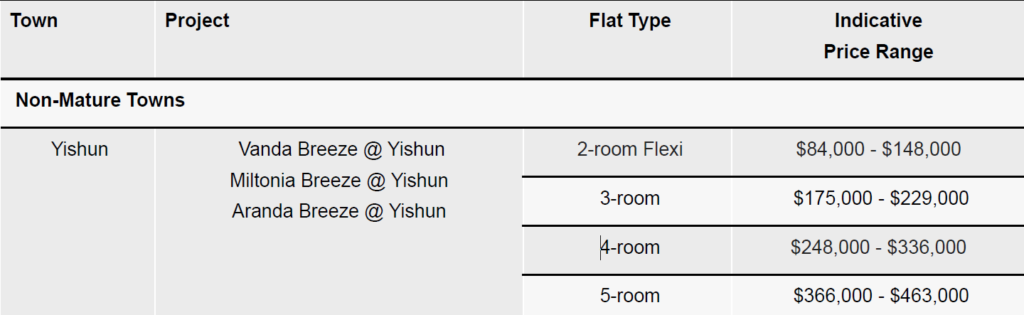

However, we also have to take look if they are able to afford to buy your unit.

Lets do some Math:

Average 4 Room BTO Price = $292k

Average 4R Resale Price = $570k

Estimated Procceds = $278k + $150k CPF = $428k

North Gaia 3BR 969 sqft @ 1.2mil, will these BTO owners be able to afford it? Answer is Yes.

Because,

Downpayment for 1.2mil + Buyer’s Stamp Duty = $332,600

They will even have a surplus of $95,400 which can last them up to 3 to 5 years depending on the interest rate.

With all the past transaction data, analysis, and calculations considered, can we confidently assert that North Gaia is a secure investment in this market?