Get ahead of the game

Don’t wait – start building your future!

Create your own success story with new launch condominiums in Singapore with SG Condo Launchpad

Act now and seize the opportunity to secure your ideal condo with

– Unbeatable Direct Developer Pricing

– Exclusive Early Bird Access

– ZERO Agent Commission

Why Choose Us ?

01

SAVE

0% agent commissions and enjoy exclusive early bird access and direct developer pricing

02

START TO FINISH

We provide end-to-end support for your new launch condo journey, from the initial search to your exit strategy.

03

PERSONALISED SERVICE

Start Your Property Journey Here

Nava Grove 宁芳苑

Nava Grove 宁芳苑

Emerald of Katong 嘉乐轩

Emerald of Katong 嘉乐轩

Novo Place (EC)

Novo Place (EC)

Norwood Grand 景林嘉园

Norwood Grand 景林嘉园

Meyer Blue

Meyer Blue

The Chuan Park 鑫丰瑞府

The Chuan Park 鑫丰瑞府

Insights

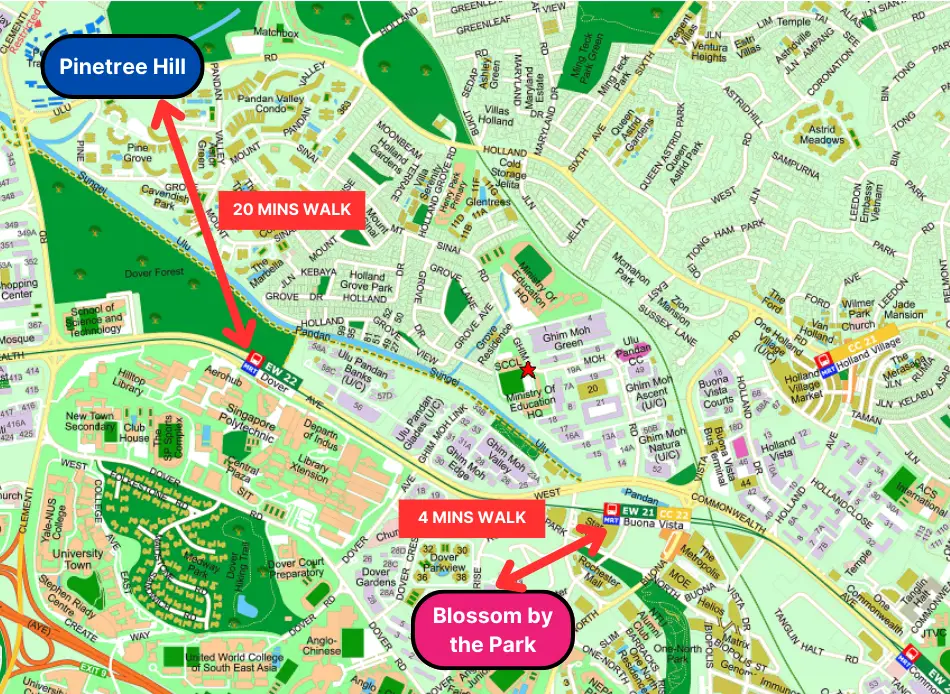

Our Honest Review of Pinetree Hill: Why We Believe the 2-Bedroom Units Offer a Safe Entry Price

Lentoria can buy or cannot?

Everything You Need to Know About Deferred Payment Scheme (DPS) for Executive Condo (EC)

FAQ

- Evaluate your finances and secure an Approval in Principle (AIP) from a bank.

- Research and shortlist new launch condo projects based on location, amenities, unit size, and pricing. Contact a real estate agent for more information if needed.

- Arrange a visit to show flats and explore the actual location for proximity to essential facilities.

- Reserve your preferred unit by paying a 5% booking fee in cash and signing the Option to Purchase (OTP).

- Engage a solicitor and finalize your loan with the bank using the OTP. Obtain a Letter of Offer.

- Review and sign the Sales & Purchase Agreement (SPA), making the initial down payment. Prepare for stamp duty and legal fees.

- Follow the progressive payment schedule as construction progresses.

- Collect the keys upon completion (TOP) of the condo.

- Thoroughly inspect the unit for defects during the Defects Liability Period (DLP).

- Enjoy your new home!

If you need assistance or have any questions throughout this process, don’t hesitate to reach out to us. Our team is here to help you make an informed decision and guide you through the purchase of your new launch condo.

Registering your interest in a new condo project is easy and convenient. SG Condo Launchpad provide comprehensive information on upcoming condo launches in Singapore.

To register your interest, simply fill out the registration form and submit it. Once you’ve done that, you can expect to receive regular updates about the project. You’ll receive periodical newsletters, brochures, and exclusive invitations to visit the show flats. It’s essential to keep an eye on these updates as they will keep you informed about the project’s progress, launch date, and any opportunities to view the show flat or make a purchase

Act promptly and stay engaged, as developers often share important news with agents and registered individuals first. By taking these steps, you’ll be well-positioned to make informed decisions and seize potential opportunities in the new launch condo market.

Stage 1: Before monthly loan repayments

- Secure the Option To Purchase (OTP): Pay a 5% booking fee in cash to obtain the OTP.

- Exercise OTP and sign Sales & Purchase Agreement (S&PA): The OTP must be exercised within three weeks after signing the S&PA, which allows you to purchase the property. Pay any applicable stamp duties and a 15% down payment within eight weeks from the Option date. Payment can be made in cash or through your CPF Ordinary Account (OA).

Stage 2: Start of monthly loan repayments through bank loan

- Completion of Foundation Work: Pay 5% of the purchase price.

- Completion of Reinforced Concrete Framework: Pay 10% of the purchase price.

- Completion of Brick Walls: Pay 5% of the purchase price.

- Completion of Ceiling/Roofing: Pay 5% of the purchase price.

- Completion of Doors & Windows Frames, Electrical Wiring & Plumbing & Internal Plastering: Pay 5% of the purchase price.

- Completion of Car Park, Roads and Drains: Pay 5% of the purchase price.

- Obtaining Temporary Occupation Permit (TOP): Pay 25% of the purchase price.

- Upon Production of the Certificate of Statutory Completion (CSC): Pay the remaining 15% of the purchase price.

The progressive payment scheme for purchasing properties under construction offers flexibility, aligns payments with construction progress, supports gradual investment, aids in financial planning, and may lead to cost savings. Talk to us today to find out how and why this progressive payment scheme can benefit you.

When deciding between a freehold and leasehold condominium, it’s important to consider that freehold properties are generally seen as more valuable because they cannot be reclaimed by the government and can be inherited by future generations. In Singapore, there are three types of tenures: freehold, 99-year leasehold, and 999-year leasehold (which is similar to freehold). Freehold properties can be held indefinitely, while leasehold properties revert to the state when the lease expires, leading to the loss of ownership rights.

Our team is well-versed in the nuances of both options, and we’re here to provide you with a comprehensive understanding of the pros and cons. By evaluating your specific requirements and investment goals, we can offer tailored advice to guide you towards the most suitable option. Don’t hesitate to reach out to us – we’re here to help you make an informed decision that aligns with your preferences.

Yes, foreigners can buy new launch condos in Singapore. However, foreigners who want to buy residential property in Singapore usually have to pay an additional stamp duty called the Additional Buyer’s Stamp Duty (ABSD), which is 60% of the property’s value.

However, there are exceptions for nationals or permanent residents of certain countries. Citizens or permanent residents of Iceland, Liechtenstein, Norway, Switzerland, and the United States of America are eligible for ABSD remission under Free Trade Agreements (FTAs) signed by the Singapore Government. This means that if you are from one of these countries, you won’t have to pay any ABSD on your first residential property purchase in Singapore.

In addition to the purchase price and stamp duty, there are several other fees involved when buying a new launch condo. These include:

Legal Fees: These fees cover the cost of engaging a lawyer or conveyancer to handle the legal aspects of the purchase, such as preparing the necessary documents and conducting title searches.

Financing Costs: If you require a home loan or mortgage to finance the purchase, there may be associated costs. These can include loan application fees, valuation fees, and other charges imposed by the banks.

Maintenance Fees and Sinking Fund: Once you become the owner of the condo, you will be responsible for paying monthly maintenance fees. These fees cover the upkeep of common areas and facilities within the condominium. Additionally, a sinking fund is often established to cover long-term repairs and replacements.

Understanding these various fees and costs is crucial to accurately budgeting for the purchase of a new launch condo.