In 2023, we find ourselves amidst a unique landscape where the demand for real estate may not be as robust as it once was in 2021. Yet, what piques our curiosity is the remarkable resilience of property prices, seemingly unwavering despite changing market dynamics. Today, we’ll uncover the reasons behind this stability, the impact of government land sales (GLS), and how developers adapt to the current cautious market.

The Role of Government Land Sales (GLS)

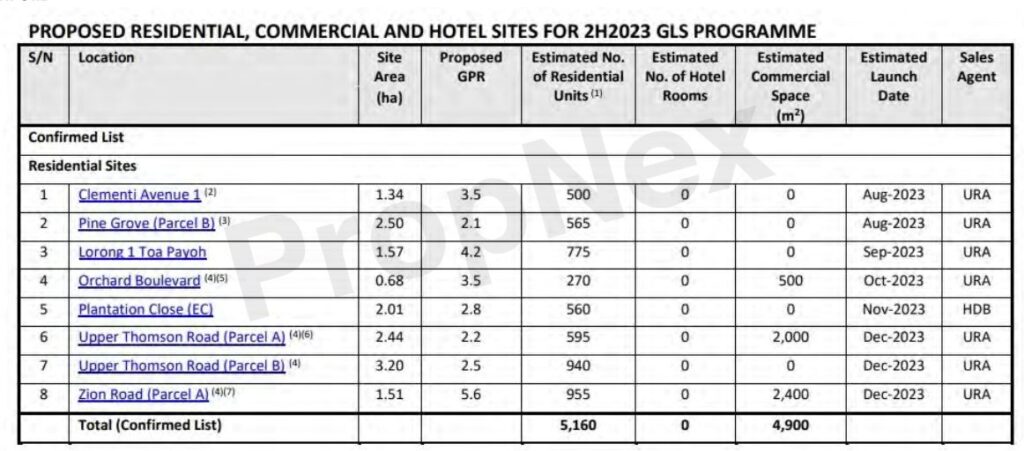

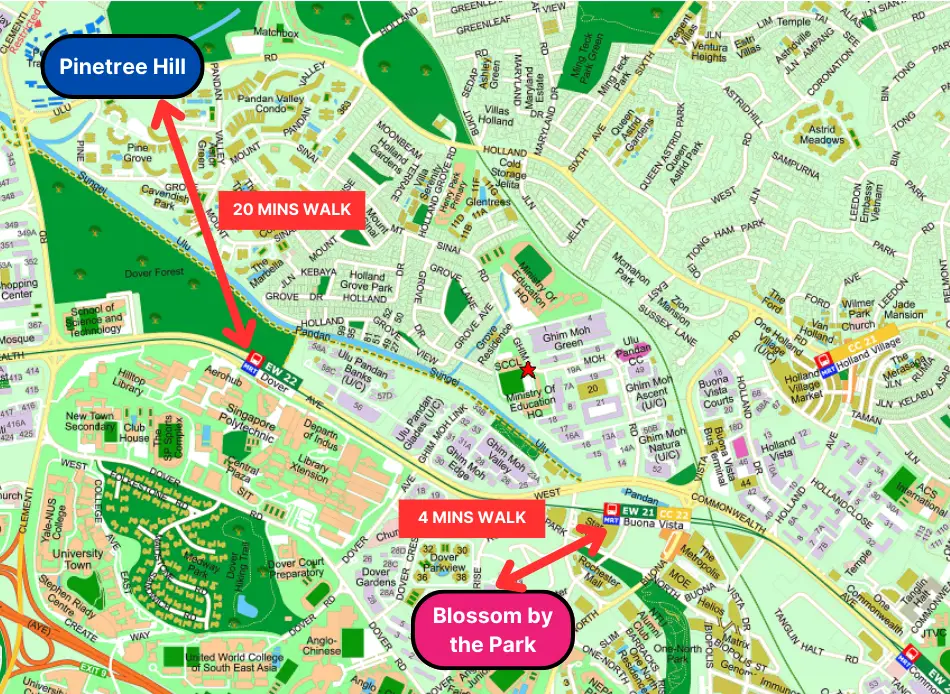

To address concerns about skyrocketing property prices, the Singaporean government has increased the number of Government Land Sales (GLS). By releasing more land for development, the government aims to keep prices in check and prevent sudden price spikes. Furthermore, the proposed GLS are actually in a relative good location and developers will also ensure that they bid a good price for these plots of lands.

However, with increase in GLS, does it mean a lower bids or even selling price or does it means that if developers successfully bid lower, they will be sell lower?

With developers getting access to more land, one might think they would lower the prices to attract buyers. However, it’s not that straightforward.

During GLS, developers bid to buy land at competitive prices. But when they launch a new project, they consider the market conditions instead of the price that they buy at. If they see strong demand and a favorable market, they may not hesitate to set higher selling prices to maximize their profits.

The Developer’s Strategy

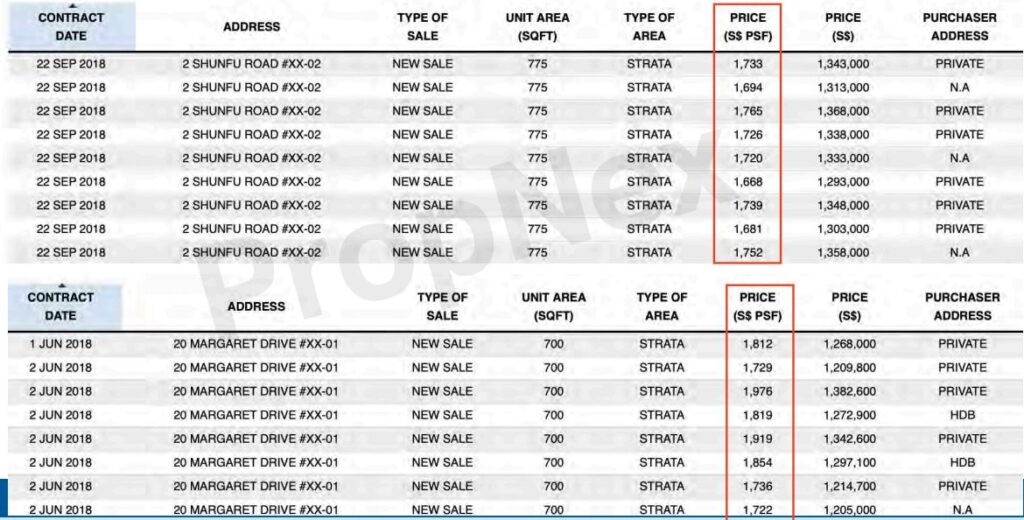

To understand better, let’s look at some examples from the past. In the Rest of Central Region (RCR), we look at two projects, Jadescape and Margaret Ville. Developers bought the land at $791 psf ppr (in May 2016) and $998 psf ppr ( Dec 2016) respectively. Developers bought the land for Jadescape cheaper compared to Margaret Ville , does it mean they will sell cheaper?

The answer is NO.

The developers launched it when market sentiment improved, and demand was higher, allowing them to make good profits.

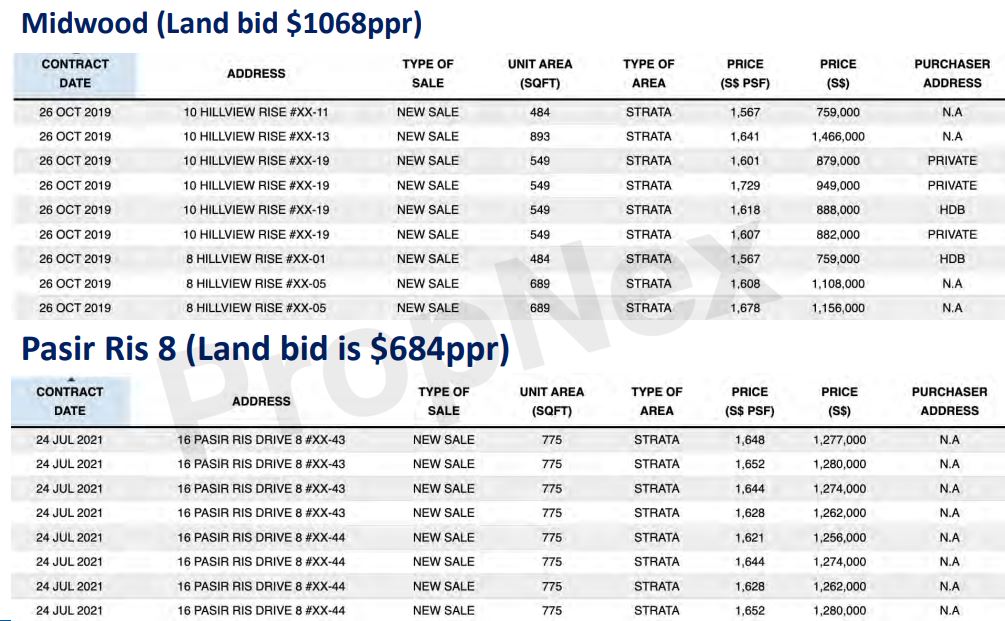

Similarly, in the Outside Central Region (OCR), we can compare two projects: Midwood and Pasir Ris 8. The land price is $1068 psf ppr (bought in May 2018) and $684 psf ppr (bought in Dec 2018) respectively. Cooling measures in July 2018 affected both projects. The developers for Midwood launched in Oct 2019 while the developers for Pasir Ris 8 waited until 2021 when interest rates were more favorable at 0.5% and launch it at a similar pricing. This strategic timing allowed them to get better returns on their investment.

This surge in government land sales undoubtedly impacts the pricing dynamics of new property launches. One might assume that developers, armed with access to more land, would opt to set their prices lower to attract buyers. However, the reality is more nuanced. Developers, much like consumers like us, adopt a cautious and strategic approach to their investments. They keenly observe the market, waiting for the right timing and the correct alignment of demand and supply to maximize their profits.

Developers’ mindset is akin to that of shrewd investors. They recognize that the success of a project relies heavily on market demand and sentiment. As astute observers, they skillfully align their launch timings with periods of heightened demand and positive market sentiment. By doing so, they aim to optimize their returns and ensure the success of their ventures.

Conclusion

In conclusion, the Singapore property market is experiencing a shift in demand, but prices remain stable due to various factors. Government land sales (GLS) play a crucial role in keeping the market steady by providing more land for developers. However, whether developers sell their projects at lower prices depends on market conditions and their strategies.

As a buyer or investor, staying informed and understanding the market dynamics will help you make better decisions in these changing times.