The Progressive Payment Scheme (PPS) in Singapore is a structured and staggered payment plan specifically tailored for the purchase of new launch condominiums. This payment scheme is designed to offer homebuyers greater financial flexibility by spreading out the payment of the property’s purchase price over the course of the construction period. Unlike the traditional method of requiring a lump-sum payment upon completion, the PPS breaks down the payment into several installments, each corresponding to specific stages of construction.

There are two types of payment scheme, the Progressive Payment Scheme (PPS) and the Deferred Payment Scheme (DPS).

The key features of the Progressive Payment Scheme include:

- Staged Payments:

The purchase price is divided into several stages, typically tied to key milestones in the construction process. These stages may include the foundation laying, structural completion, and overall project completion. - Reduced Upfront Costs:

One of the primary advantages of the PPS is that it alleviates the immediate financial burden on homebuyers by allowing them to defer a significant portion of the purchase price. This reduction in upfront costs makes property ownership more accessible to a broader segment of the population. - Financial Flexibility:

The deferred payments enable buyers to utilize their funds more flexibly during the construction period. This could involve investing in other assets, meeting other financial obligations, or taking advantage of alternative investment opportunities. - Managed Cash Flow:

The installment-based structure of the PPS helps buyers manage their cash flow more effectively. Payments are made in stages, aligning with the progress of construction. This allows for better financial planning and budgeting

While the Progressive Payment Scheme (PPS) offers several advantages, it’s essential to be aware of potential disadvantages or considerations associated with this payment structure. Some of the drawbacks include

- Interest Costs:

Depending on the terms of the PPS, buyers may incur interest costs on the deferred payments. It’s crucial to understand the interest rates and how they can impact the overall cost of the property. Some PPS arrangements may have higher interest rates, potentially leading to increased financial burden over time. - Market Fluctuations:

The extended payment period in a PPS exposes buyers to market fluctuations. If property values decrease during the construction phase, buyers may find themselves paying more for a property than its current market value upon completion. - Limited Negotiation Power:

The PPS terms are typically set by the developer, and buyers may have limited room for negotiation. This lack of flexibility can be a disadvantage for buyers who prefer more customized payment plans or who seek more favorable terms. - Cash Flow Constraints:

While the PPS helps manage cash flow, buyers still need to ensure that they have sufficient funds available at each payment milestone. Unexpected financial challenges, such as job loss or other emergencies, could make it difficult for buyers to meet their payment obligations, leading to potential penalties or complications.

However, with enough research and homework done, buyers can mitigate these disadvantages to its advantages. They can select financing options with favorable interest rates, monitor market trends to address fluctuations, maintain a robust financial plan for cash flow and seek professional advice to align financing with individual preferences and risk tolerances.

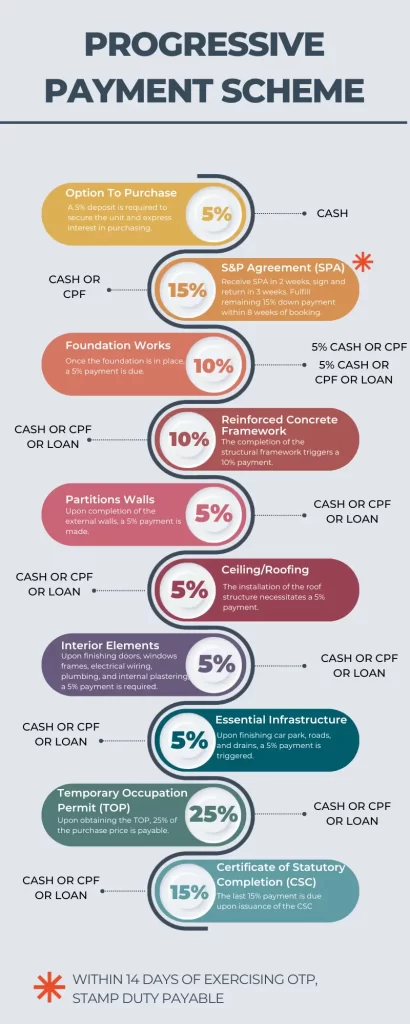

The Different Stages of the Progressive Payment Scheme:

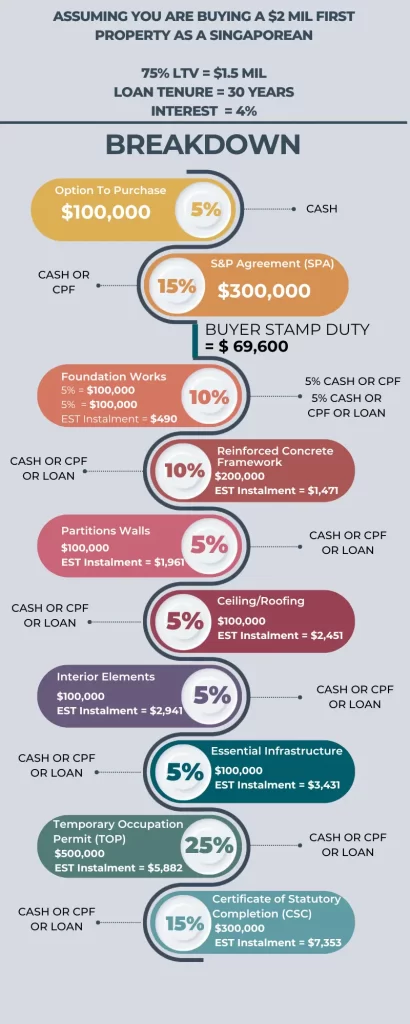

The initiation of monthly instalments is tied to the bank’s disbursement, determined by the loan-to-value ratio of the purchase. If you secure a 75% loan, the first disbursement occurs upon the completion of the foundation stage, marking the commencement of monthly payments. In the case of a 60% loan, the initial disbursement is linked to the completion of the partition wall, triggering the start of instalments.

It’s important to note that developers might notify the completion of multiple stages simultaneously, leading to a total sum disbursement by the bank.

Additionally, if the property is purchased after the launch period, for example 1 year later and developer has already completed the Reinforced Concrete Framework Stage, the developer may call for several progressive payment stages, such as foundation and reinforced concrete framework payments, collectively after the signing of the Sales and Purchase agreement.

Example:

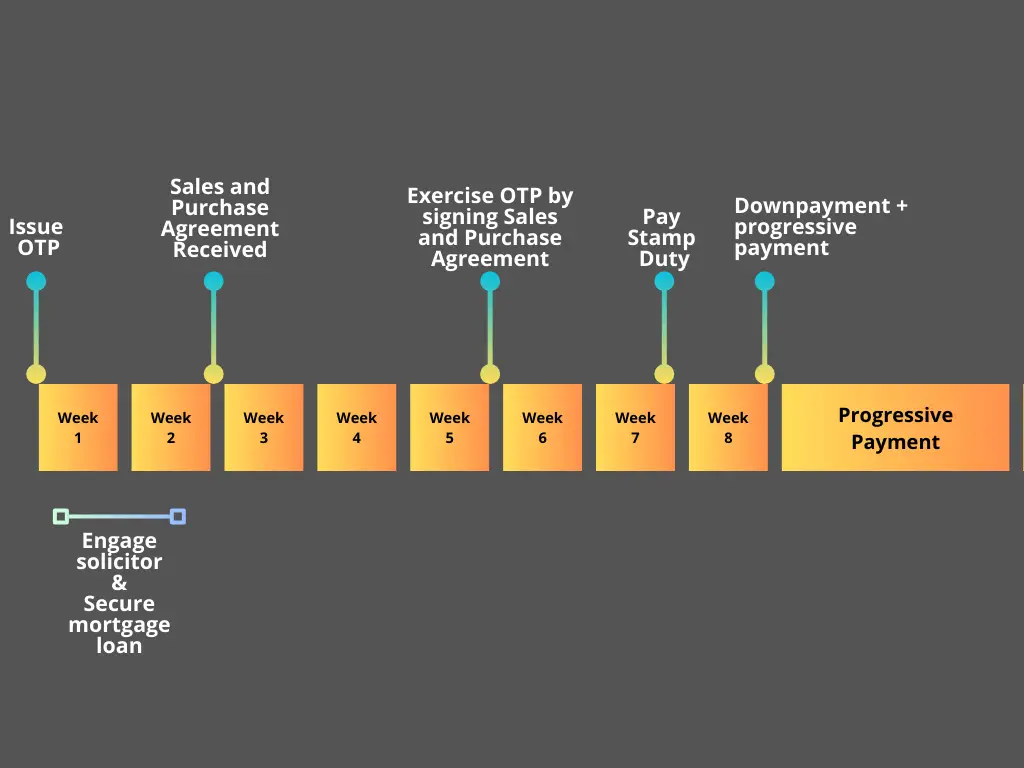

Once you made a booking fee of 5% in CASH, OTP will be issued to you and you can use this OTP to secure a mortgage loan from the bank.

However, it is advisable to get an In-Principle Approval (IPA) from the bank before making this booking fee. An In-Principle Approval (IPA) is a preliminary document issued by a bank, indicating its willingness to provide a loan for your home purchase. This non-binding document serves as an assurance but does not constitute a formal agreement.

The developer will then deliver an document known as the Sales and Purchase Agreement within 14 days from OTP. You will need to exercise the OTP by signing the Sales and Purchase Agreement within 3 weeks from receiving. The OTP will expired within that 3 weeks. Once signed, you will have 14 days to pay for the Stamp Duty and Legal Fee.

8 weeks from OTP, 15% initial downpayment is payable.

It is important to note that other than the Buyer Stamp duty, there are also miscellaneous fee such as Legal Fee ($2500-$4000) and valuation fee ($350-$500)

After that, if you are taking a bank loan, the bank will disburses the fund to developer at each completion stage and your instalment will kick in.

In summary, the Progressive Payment Scheme (PPS) in Singapore provides a structured framework for property buyers, allowing for a phased approach to payments throughout the construction process. This system offers advantages such as reduced upfront costs, improved financial flexibility, and better cash flow management. However, it’s important to note potential considerations, including interest costs and market fluctuations. Buyers can navigate these aspects by carefully assessing financing options and staying informed about market trends.

You can learn more about the Deferred Payment Scheme (DPS) here

Our team is equipped to provide you with comprehensive information and guidance tailored to your requirements.

Connect with us on Telegram and stay in the loop with developer updates as they happen!