In Singapore, Executive Condominiums (EC) are a type of housing option that is considered a hybrid between public and private housing. These developments are usually offered by private developers and are subject to certain eligibility criteria.

There are two types of payment scheme, the Progressive Payment Scheme (PPS) and the Deferred Payment Scheme (DPS).

The Progressive Payment Scheme (PPS) and Deferred Payment Scheme (DPS) are two distinct payment structures. PPS involves buyers making payments at various stages of construction completion, distributing the financial burden throughout the building process. In contrast, DPS allows buyers to postpone a portion of the purchase price until a later date, often after the property’s completion. While PPS facilitates gradual payments tied to construction milestones, DPS provides buyers with greater flexibility by deferring a portion of the total cost until a specified future point.

The DPS is currently available as an alternative payment scheme for EC. Some of the private condo might also offer this scheme to boost sales.

So what is Deferred Payment Scheme for EC?

Deferred payment schemes for ECs allow eligible buyers to defer the payment of a portion of the purchase price until a later date. This scheme is intended to make it more financially feasible for buyers, as they can defer a significant portion of the payment to a future point, typically after the development has been completed. Of course, DPS has both advantages and disadvantages, and its suitability depends on individual circumstances.

Pros:

- Choosing the Deferred Payment Scheme (DPS) for Executive Condominium (EC) buyers eliminates the need to manage two mortgage loans simultaneously.

- Buyers will be able to stay in their current HDB while waiting for the construction of their EC.

- No loan repayments are mandated during the construction period under the DPS.

- The scheme provides flexibility for buyers with existing loan repayments, allowing them to manage their finances more effectively.

Cons:

- Opting for the Deferred Payment Scheme (DPS) entails an additional cost, with a typical markup of around 3% over the selling price

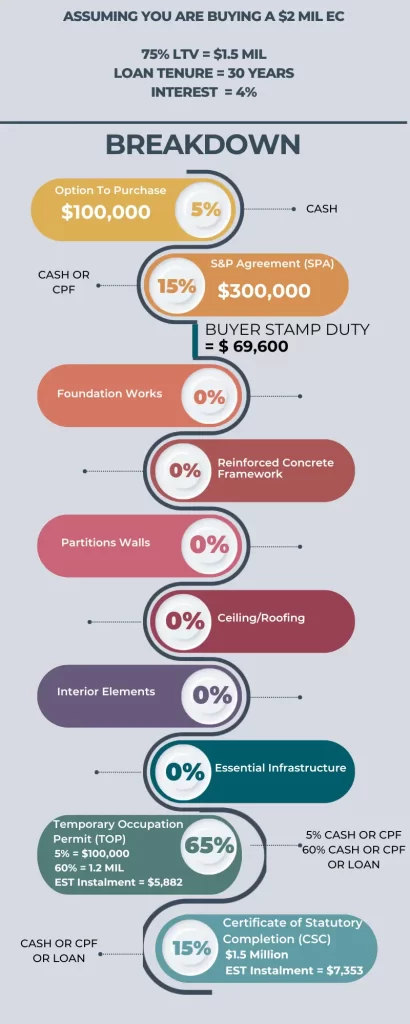

The Different Stages of the Deferred Payment Scheme (DPS) :

Example:

In summary, the Deferred Payment Scheme (DPS) offers both advantages and disadvantages for property buyers. On the positive side, it provides financial flexibility by allowing a delay in mortgage payments, particularly beneficial for those with existing loans. However, the scheme comes with a price, typically a markup of around 3% over the selling price. While this additional cost may be justified by the convenience of a lower upfront downpayment and a deferred payment period, buyers need to carefully consider their financial situation and weigh the long-term implications before opting for the DPS.

You can learn more about the Progressive Payment Scheme here.