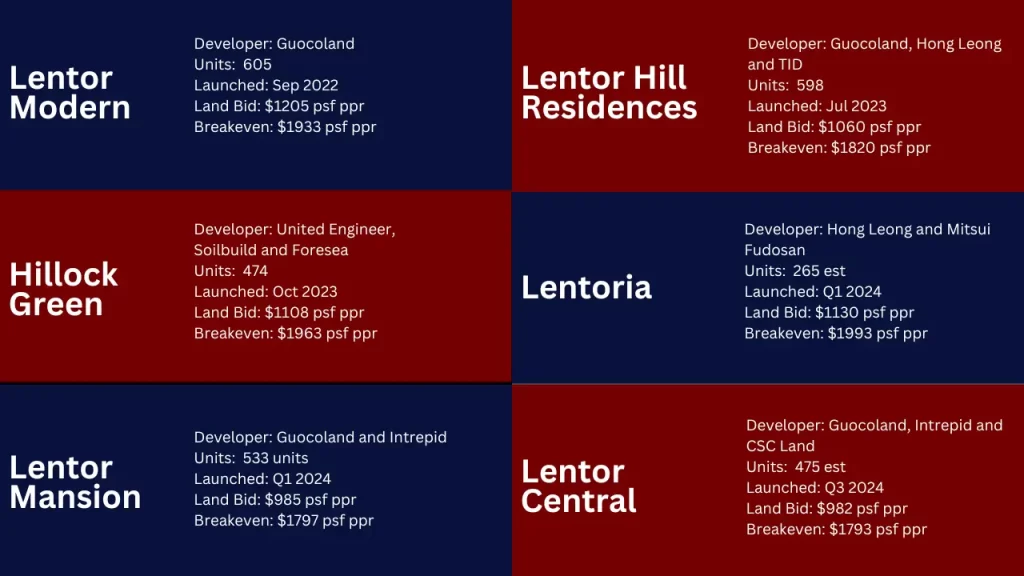

Seven new Government Land Sales (GLS) plots have taken center stage, promising a wave of change. Lentor Estate undergoes a remarkable transformation with an influx of residential projects. With close to 3,800 units expected to TOP between 2026 and 2028, is there an impending oversupply of units, and should one seize the moment or exercise patience in this dynamic market? This comprehensive review delves into key aspects of the Lentor property market, providing factual insights and a neutral perspective to guide prospective buyers

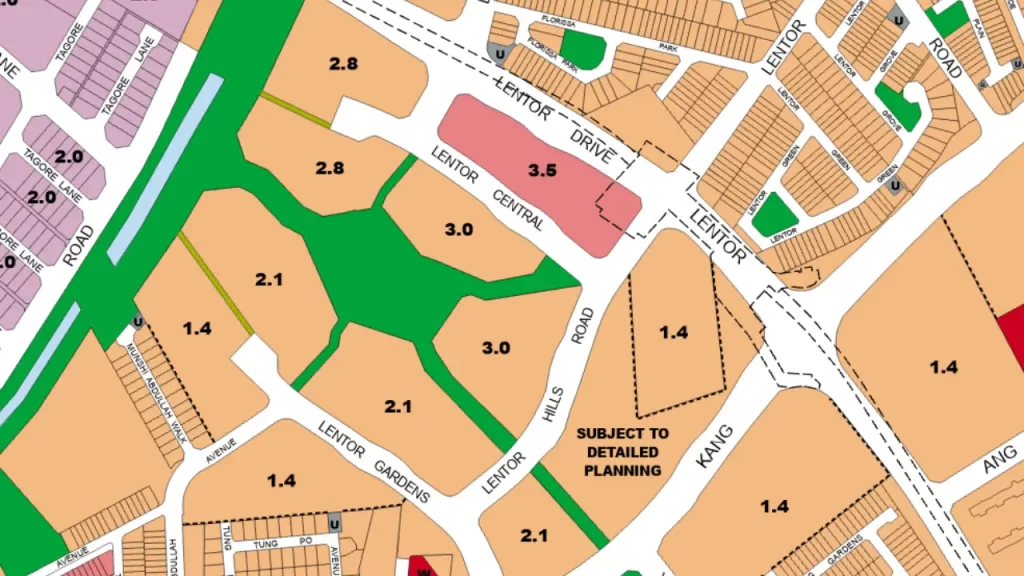

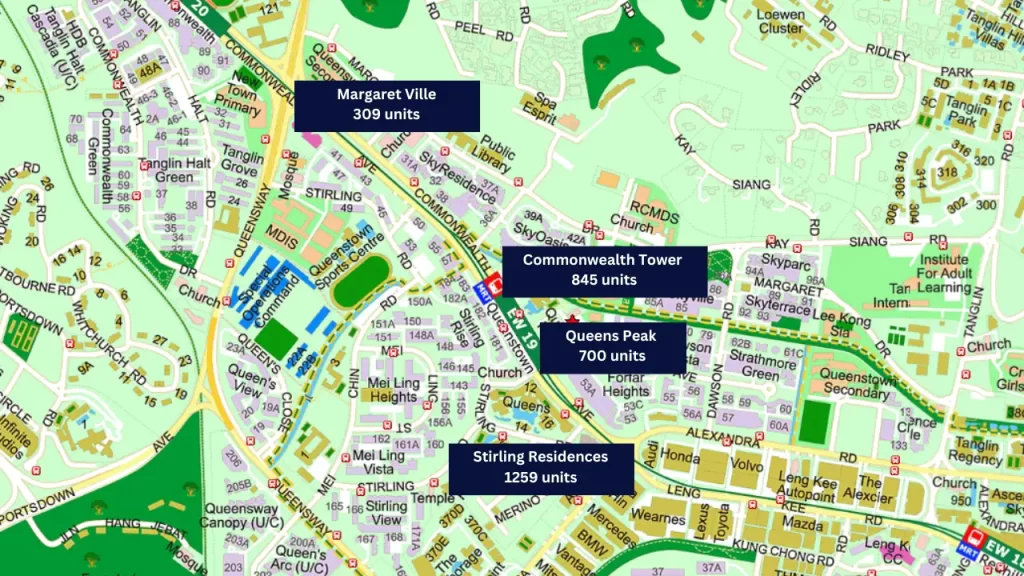

Additionally, there’s one more piece of land (marked in orange) that has the potential to bring about 500 more housing units.

You can read more about the specific projects here:

- Lentor Modern

- Lentor Hill Residences

- Hillock Green

- Lentoria (Comprehensive Review of Lentoria here)

- Lentor Mansion

- Lentor Central

In the quest to boost residential housing in the Lentor neighborhood, 7 Government Land Sale (GLS) sites have been designated for upcoming development. These sites are strategically positioned around an existing grassy hillock. According to the Urban Redevelopment Authority’s (URA) urban concept plan for the neighborhood, this small hill is envisioned to serve as the central green space and park area. It will act as the focal point radiating towards various linear parks in the surrounding vicinity.

We’ve noticed varied bidding scenarios for different Lentor projects – Lentor Modern attracted interest from 9 bidders, followed by Lentor Hill Residences with 4, Hillock Green with 3, Lentor Central with 2, and Lentor Mansion with only one bidder, clinching a record-low price. It’s worth noting that GuocoLand and Hong Leong Group emerge as key players in these land bids, suggesting a potential for market control and pricing influence.

The decreasing number of bidders in each auction might stem from GuocoLand’s dominance in the Lentor estate. Developers could be exercising caution, perhaps hesitant to enter a market where GuocoLand holds sway. Another contributing factor might be the diversification of land sales to other regions in Singapore, drawing potential bidders away from Lentor and dispersing competition.

However, it’s essential to recognize this as a developer-driven strategy. As individual buyers, it’s advisable not to be unduly swayed by these tactics. Instead, focus on your preferences and aim for a safe entry price.

Lets just look at Lentor as a whole:

The development landscape in Lentor unfolds with at least 12 residential plots. It commenced with Lentor Modern, the inaugural plot that integrates with the MRT, marking the initiation of a significant transformation in the area.

In Lentor, there’s a noteworthy sequence – before the government releases land, the MRT is already operational. This stands in contrast to certain locations where development precedes MRT construction. In Lentor, the established MRT infrastructure prior to land releases signifies a pre-existing accessibility advantage, potentially influencing the development dynamics in the area. The Thomsom-East Coast Line is already operating for Lentor MRT. It only take less than 20 mins from Lentor to Orchard or if you are a frequent JB traveller, it is only 2 stops away!

In the URA space, our attention is drawn to two HUGE residential land plots in the Tagore Area. What adds a promising dimension to this observation is the planned support of an upcoming MRT station. This intriguing combination fuels speculation that the Tagore Area might potentially evolve into the next township.

Let’s explore in greater detail the queries that potential buyers may encounter as they contemplate entering the Lentor market.

Question 1: Does having an excess of properties in close proximity makes me lose money?

The concerns about potential oversaturation in the housing market are valid, particularly due to the simultaneous completion of seven new housing projects in close proximity. With a total of 3000 units entering the market within a three-year period (2026-2028), the key challenge is not just the concentration of condos but the rapid influx of supply in a short timeframe. The primary consideration shifts to the feasibility of selling when facing nearly 3000 competitors in the same area, specifically in Lentor.

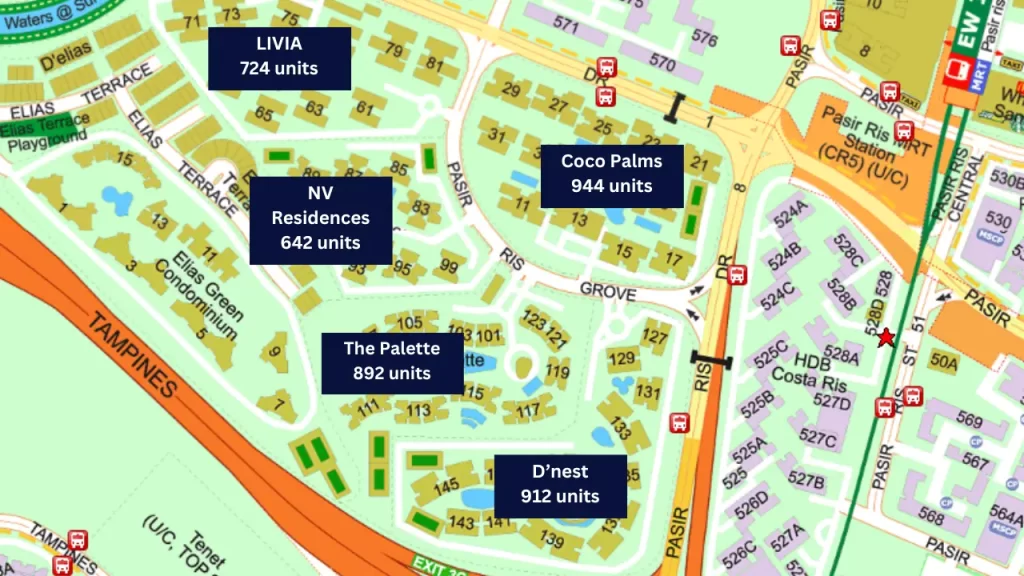

Let’s examine historical data in areas that experienced oversupply within a few years and analyze how property owners managed to profit from such situations.

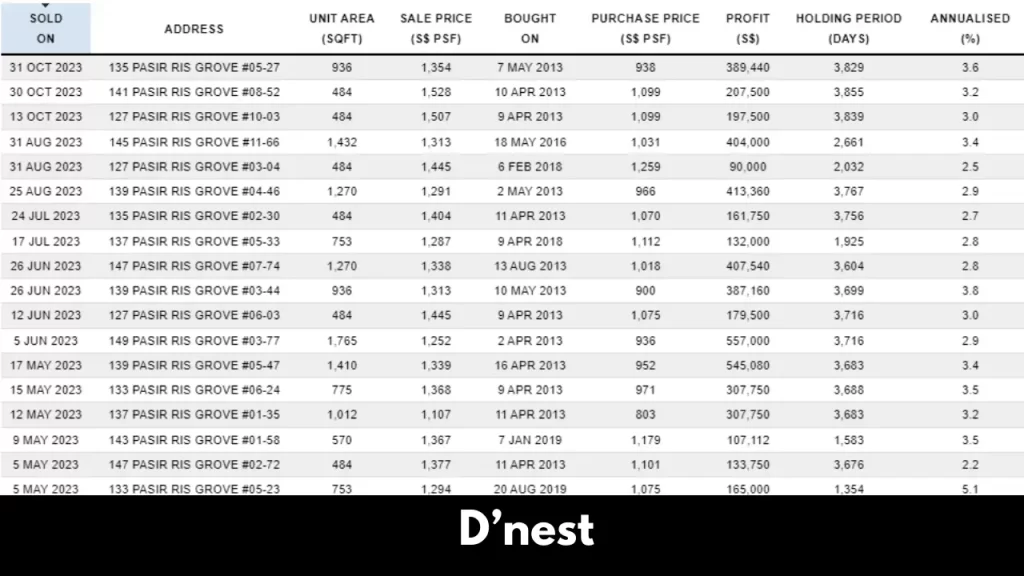

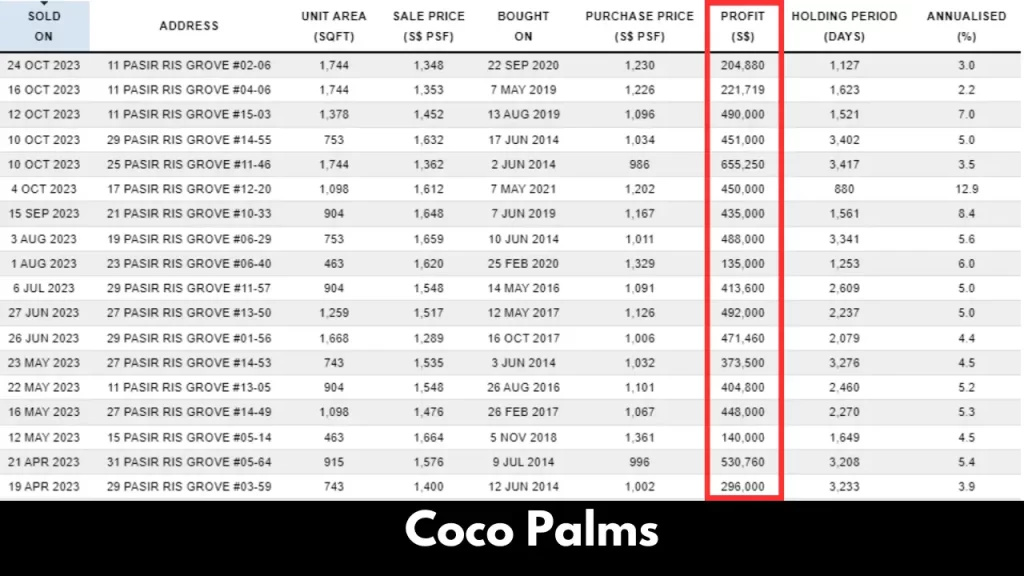

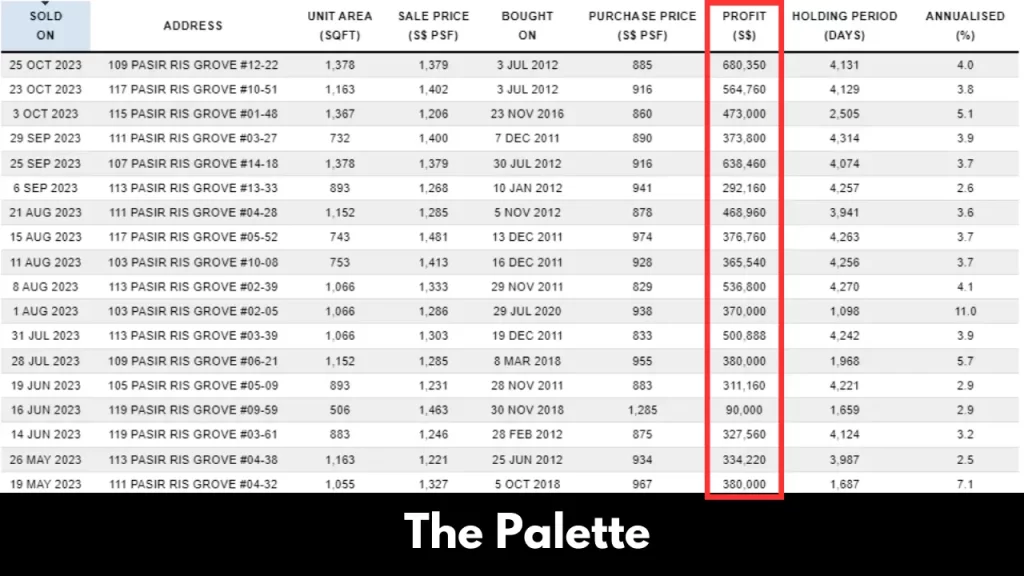

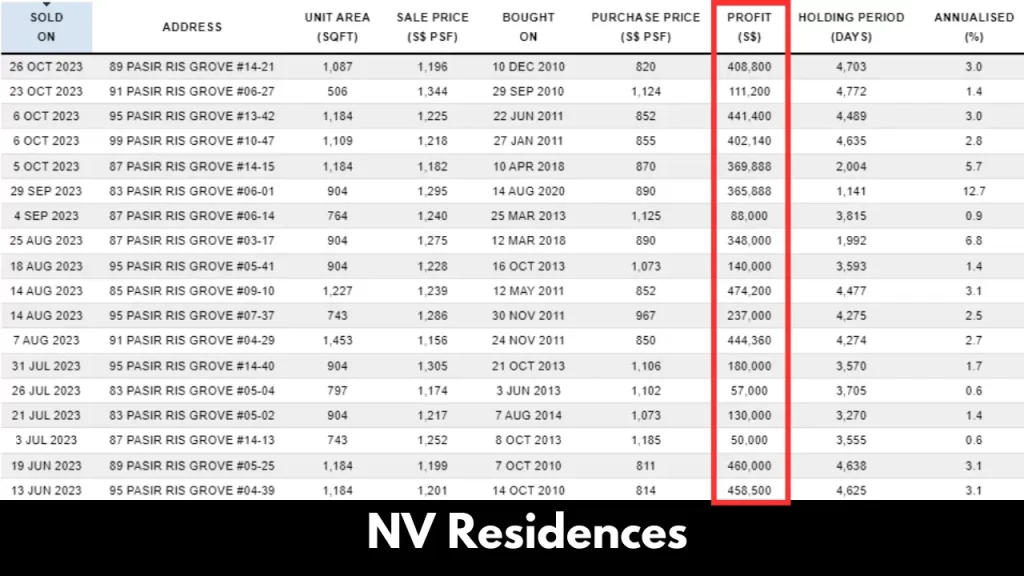

Pasir Ris Grove Area:

There is a total of 4114 units in the span of 5 years.

However, look at the profits that these owners are making.

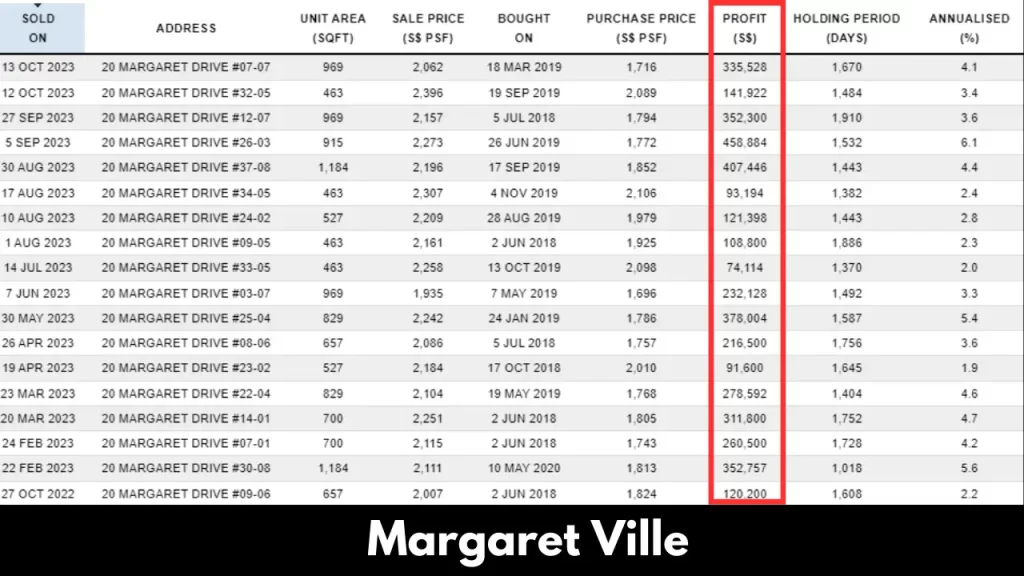

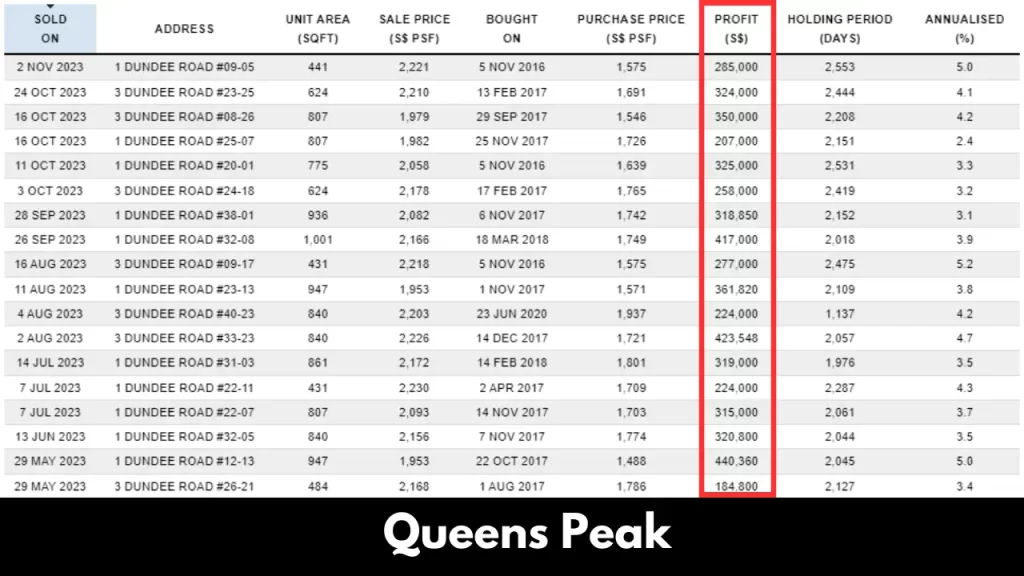

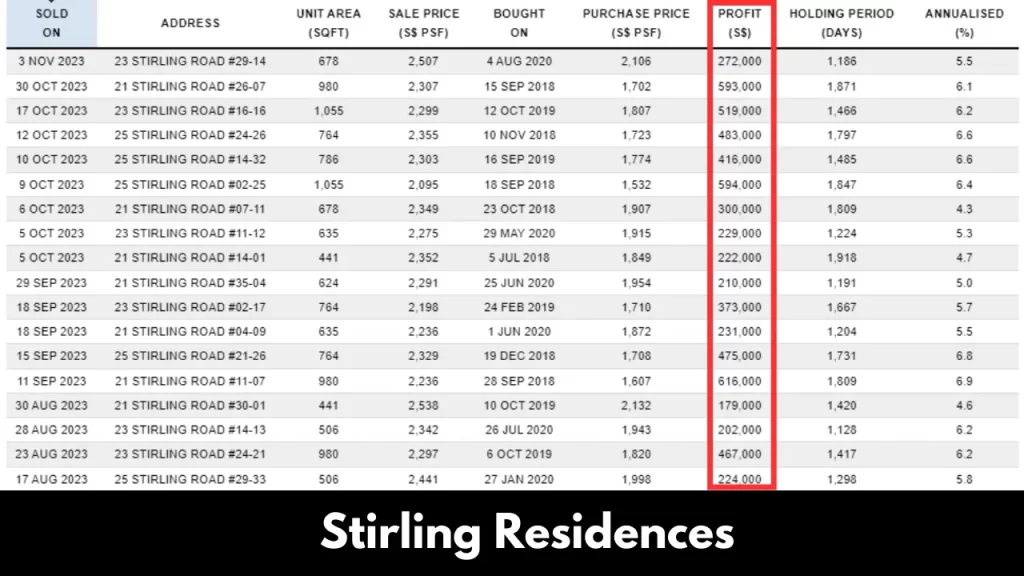

Queenstown Area:

There is also an influx of 3113 units in the span of 4 years.

Lets see how much the owners are making right now?

These case studies show that having too many properties in an area doesn’t always lead to financial losses, based on historical data. However, it’s important to understand that some deals were not profitable. This could be due to factors like buying at the wrong price, choosing the wrong type of property, picking less popular layouts, and other similar reasons. How much profit you make depends on these factors.

Question 2: How should I plan my exit?

This isn’t a short-term investment, extending beyond the three-year TOP period. The prospect of 3000 units completing within 2026 to 2028 implies a potential shift towards a buyer’s market, making it challenging to flip properties upon TOP. The strategy now necessitates a 5 to 10-year horizon, allowing for the absorption of supply by the market over time. The goal is to minimize competition, optimize profit, and provide a longer window for resale buyers to enter the market when demand is expected to outpace supply.

Typically, HDB upgraders become your potential buyers when you decide to sell in the future. In the vicinity of Lentor, there are neighboring towns such as Yishun, Sengkang, Ang Mo Kio, Hougang, Bishan, and Serangoon. With a combined total of nearly 300,000 households, there’s a substantial pool of potential upgraders. Even if only 2% of them are interested in upgrading and moving to the Lentor region, you could potentially have around 6,000 prospective buyers.

Furthermore, given the potential establishment of a township in the Tagore Area and ongoing development initiatives in the Lentor region, there is anticipated demand entering the market. Consequently, the likelihood of oversupply diminishes.

In essence, the expectation is that buyers will outnumber sellers after 5 to 10 years, creating a more favorable market for maximizing returns.

Question 3: Should I go for the balance unit in Lentor region or should I wait for the new units?

The Singaporean government has strategically prioritized the release of premium land plots in Lentor, with a specific focus on developments like Lentor Modern, Lentor Hills Residences, and Hillock Green, starting with those closest to the MRT.

For those emphasizing convenience, we suggest considering the remaining units in Lentor Modern as they offer potential profit opportunities. Lentor Modern caters to individuals who highly value easy access to amenities and transportation at the touch of a lift button, proving especially advantageous for demographics such as the elderly and bachelors.

In terms of educational proximity, Lentor Mansion, Lentoria, and certain blocks in Lentor Hills Residences, located within a 1km radius of CHIJ St Nicholas Girls’ School, emerge as preferred choices for parents. Specific blocks in Lentor Hills Residences may entail a premium payment, particularly for larger unit types. The 1km radius from reputable schools can be considered a potential catalyst for future buyers when you decide to sell your unit so it might be worthwhile to take a look at the balance units if there are within 1km radius.

In our perspective, it would be advisable to explore the available balance units in Lentor Modern, Lentor Mansion, and the specified blocks in Lentor Hills. These developments could potentially offer more significant profit opportunities in the future.

Consider including Lentoria in your shortlist for upcoming new launches due to the 1km radium. However, given its higher breakeven point, it is anticipated that Lentoria may be launched at a relatively higher price which we will have to ascertain whether it will be a good safe entry.