In the world of Singapore’s real estate, the North Gaia EC has been generating quite a buzz. As of today, around 44% of its units (270 in total) remain unsold, despite significant interest in the project. This has led many to wonder why an EC isn’t flying off the market.

One of the main obstacles to the North Gaia EC’s success lies in its Mortgage Servicing Ratio (MSR). Specifically, this affects buyers who are considering Executive Condominiums (ECs) and is a crucial factor contributing to the project’s slower sales.

What’s MSR, you ask?

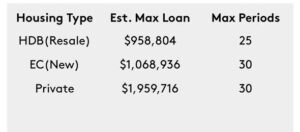

It’s a key indicator of financial prudence and stability for homebuyers in Singapore. In this case, the MSR cap stands at 30% of the gross monthly household income. The challenge arises because the prices of ECs have increased substantially over the past five years. While they have risen by over 60%, from about $800 per square foot (psf) to today’s $1,300 psf, the MSR remains stagnant at 30%.

To purchase a new EC in Singapore, buyers are obligated to abide by the MSR framework. This puts them under more stringent loan limits, resulting in a higher upfront cash requirement.

For eligibility to buy a North Gaia EC unit, your household income must not exceed $16,000. In the best-case scenario, a couple with a combined income of $16,000 can secure a maximum bank loan of $1.06 million. However, in practice, the granted loan amount often falls short of this figure. This means you could be looking at a cash outlay of about $500k if you’re eyeing a 4-bedroom unit pricing between $1.45 million.

Current and Future Competition

Despite an initial surge of interest with around 3,700 visitors during the first weekend and another 2,000 the following weekend, potential buyers seem hesitant to commit to a purchase. One reason for this hesitance could be the awareness of three more EC projects on the horizon between the third quarter of 2022 and the first quarter of 2023, namely Tengah Garden, Tampines Street 62, and Bukit Batok West Avenue 8.

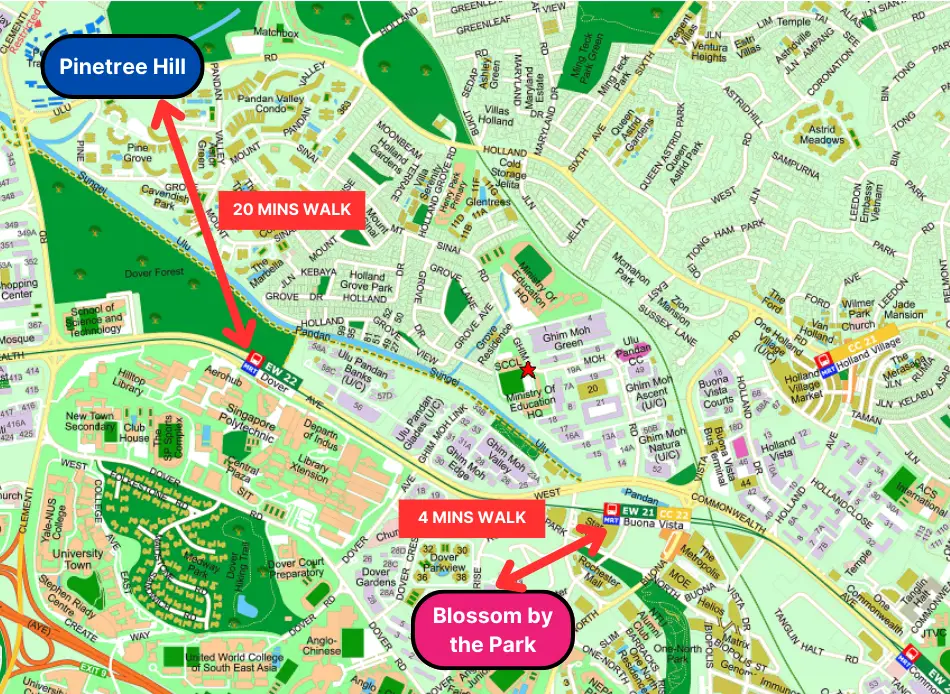

Comparatively, North Gaia’s EC launch price is close to that of Northpark Residences, a fully private condominium located conveniently within walking distance of Yishun MRT. The accessibility and convenience of this location make it a strong contender.

In conclusion, while the North Gaia EC presents an attractive opportunity, potential buyers are taking their time, likely due to the MSR framework and increasing property prices. Moreover, competition from other EC projects and alternative property options in more convenient locations may be influencing their decisions. So, if you’re considering an affordable Executive Condo, be sure to evaluate not just the initial investment but also your long-term plans.

However, the ultimate question for potential buyers is, “Is the exit strategy a strong game plan?” In property investment, your exit strategy is vital. This entails assessing the long-term value, prospects for capital appreciation, and rental income potential. It’s about making a wise financial decision that aligns with your goals.

Stay tuned for our next blog post where we will delve deeper into whether North Gaia’s exit plan might be favorable for those looking at its investment potential.