As a seasoned investor or a prospective buyer, navigating the ever-evolving Singapore property market can feel like discovering a hidden portal leading to endless possibilities. The current price frenzy might resemble a king’s ransom, but beneath the surface lies a unique chance to explore the market’s potential with a personal and professional touch. As demand for properties reaches new heights, it’s crucial to delve into the technical factors at play, enabling you to make informed decisions as a shrewd investor or potential buyer. In this comprehensive exploration, we’ll uncover the driving forces behind the soaring demand and the technical opportunities that await you in this dynamic market.

Resilience Amid Cooling Measures:

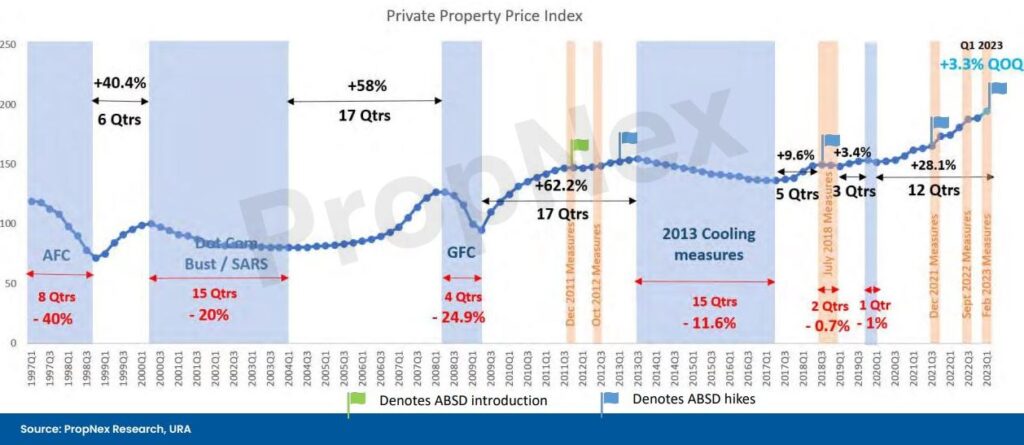

Cooling measures have been implemented to maintain market stability and sustainable growth. While they may initially thought to dampen prices, they can stimulate demand in unexpected ways, leading to incremental price increases over time. Private home prices have exhibited undeniable resilience, even in the face of crises and cooling measures. Evidence shows that private home prices have continued to inch forward. In Q1 2023, they grew by an impressive 3.3%, highlighting the enduring strength of the market.

Learning from the Past: 2008 Global Financial Crisis vs. Present:

The landscape of the property market has transformed significantly over the years. Today, property owners must possess holding powers and qualify for loans, ensuring a more stable market during times of crisis. Unlike the lack of cooling measures during the 2008 financial crisis, today’s market is better equipped to weather challenges, making it a more secure investment opportunity. Back then, when owners are affected by a crisis, they will started to sell their properties. The market in turn experienced a meteoric downfall, with properties being discarded like space debris. Today, property owners are required to possess holding powers and meet loan qualification criteria. As a result, entering the market demands financial preparedness, contributing to the market’s stability even during periods of crisis.

The Unwavering Upward Trajectory:

A two decade-long analysis of property prices reveals an unwavering upward trajectory, with each peak surpassing the previous one and each low remaining higher than before. This consistent pattern showcases the market’s strength and the ever-increasing value of properties, making it an attractive investment option. Even during periods of decline or correction, the market has bounced back with each low surpassing the previous one, reinforcing the resilience and growth potential.

AND WHY IS THIS HAPPENING?

The pricing in the market remains resilient or is on an upward trajectory due to THREE powerful driving forces.

Reason 1: Supply Constraints and Limited Land

Singapore’s land scarcity limits the supply of new properties, putting upward pressure on prices. A decrease in sales volume may lead to reduced project launches by developers, further tightening the supply-demand balance. As a result, the limited supply relative to demand can drive price appreciation.

Reason 2: Pent-up Demand and Buyer Behavior

A decline in sales volume can trigger pent-up demand among potential buyers, who seize the opportunity to enter the market when prices are perceived to be more favorable. This surge in demand intensifies competition, bidding up property prices.

The sales volume in the market is a reflection of buyers’ and investors’ sentiment. During periods of low sales volume, buyers may be cautious, waiting to see how prices evolve. However, when sales volume declines and property prices start to rise, it indicates a boost in market confidence. This increased confidence attracts both investors and genuine buyers who don’t want to miss out on potential gains, driving further price growth.

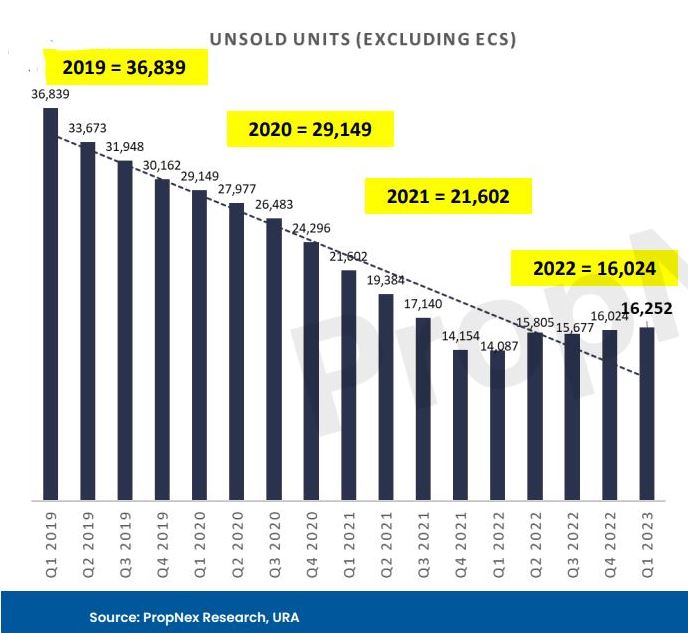

Looking at the graph, the current sales volume stands at 6850, and our prediction indicates it will likely reach 8000-9000 by the end of 2023. Additionally, there is a limited supply of unsold units, with only 16252 available. This scarcity of supply puts upward pressure on property prices. Considering these factors, it’s highly probable that property prices will continue to inch forward.

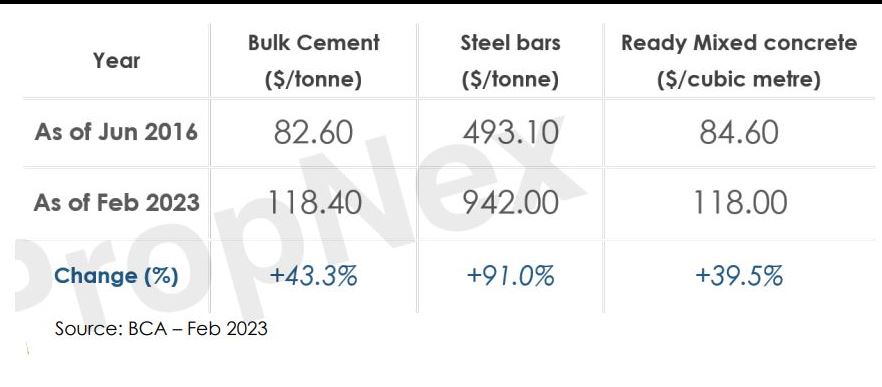

Reason 3: Rising Construction Costs and Supply Dynamics

Higher construction costs can influence property prices as developers pass on expenses to buyers to maintain profit margins. Moreover, developers may become more cautious about launching new projects or expanding portfolios due to increased financial risks, leading to a reduction in overall property supply.

THEN HOW DO WE KNOW WHEN TO ENTER THE MARKET?

Sales Volume as a Key Indicator:

Sales volume serves as a crucial indicator of market activity and demand. A downward trend in sales volume may signify decreased transactional activity and buyer interest, while an increase can indicate heightened demand and market confidence. Understanding this relationship is essential for understanding the subsequent impact on property prices. Hence, when you look at the graph, it is easy to time the market. Buy when there is a downward trend in sales volume because looking at the graph over the last 20 years, those who bought during the low sales volume period has seen their property price increases.

While the sales volume and supply constraints are crucial indicators of the market’s health and potential price movements, there are other key signals that savvy investors and buyers should consider before making their move. We understand that timing is critical in the ever-evolving Singapore property market, and there are various factors to take into account to make informed decisions.

Conclusion

The Singapore property market continues to display remarkable growth and resilience, making it an enticing investment prospect for astute investors. By carefully analyzing market trends and leveraging the current dynamics, you can position yourself strategically for future success. So, seize this window of opportunity and explore the lucrative prospects that the Singapore property market has to offer.