TO NEW LAUNCH BUYERS,

Do you know that LAYOUTS will affect your

PROPERTY PROFIT MARGIN?

Can you confidently pick the better layout between two units in the same development at a glance?

If so, you’re good to go.

But if not, don’t worry.

Buying property is one of the biggest investments we make in our lifetime, whether it’s for personal residence or investment purposes. To seize opportunities and maximize our assets and profits in the dynamic real estate market, it is essential to have a comprehensive understanding of the property in question.

Selecting layout is one the vital strategies for securing a competitive edge in the market, surpassing not just your neighbors within the development, but also those in the surrounding area.

Be like Ron

When overwhelmed by options in the new launch property market, my friend Ron sought my advice. After employing various strategies, we narrowed down choices, prioritizing personal preference alongside financial considerations. Using the Layout Selection Strategy for unit selection within the preferred development, Ron and his family now enjoy substantial profits, showcasing the strategy’s effectiveness.

Let's get started with the case study

These three case studies have been chosen because each property in their respective case study is similar in terms of location, size, and type. With these common characteristics, it can be accurately demonstrated why the selection of certain layouts plays a massive role in determining potential capital appreciation.

CASE STUDY 1

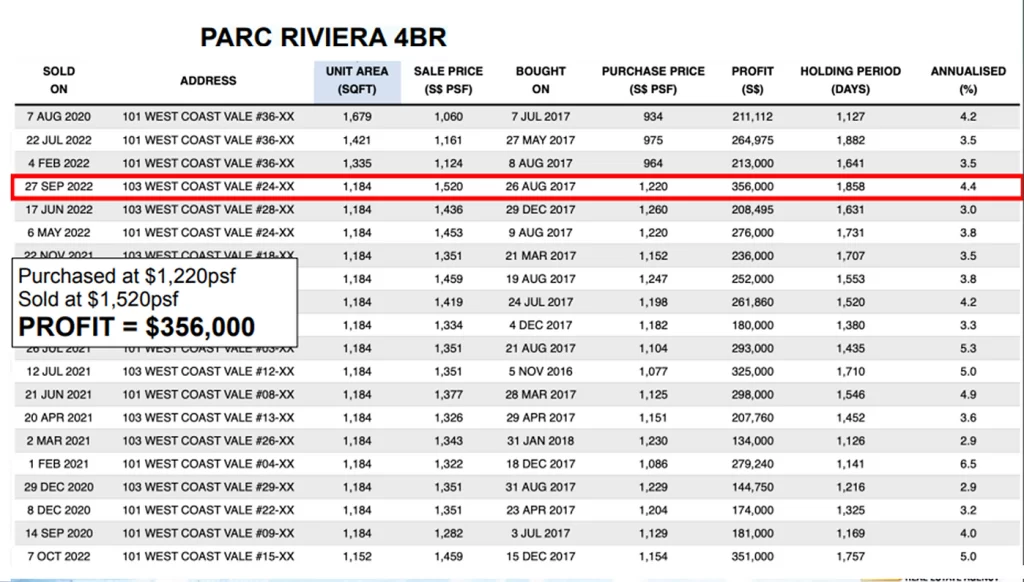

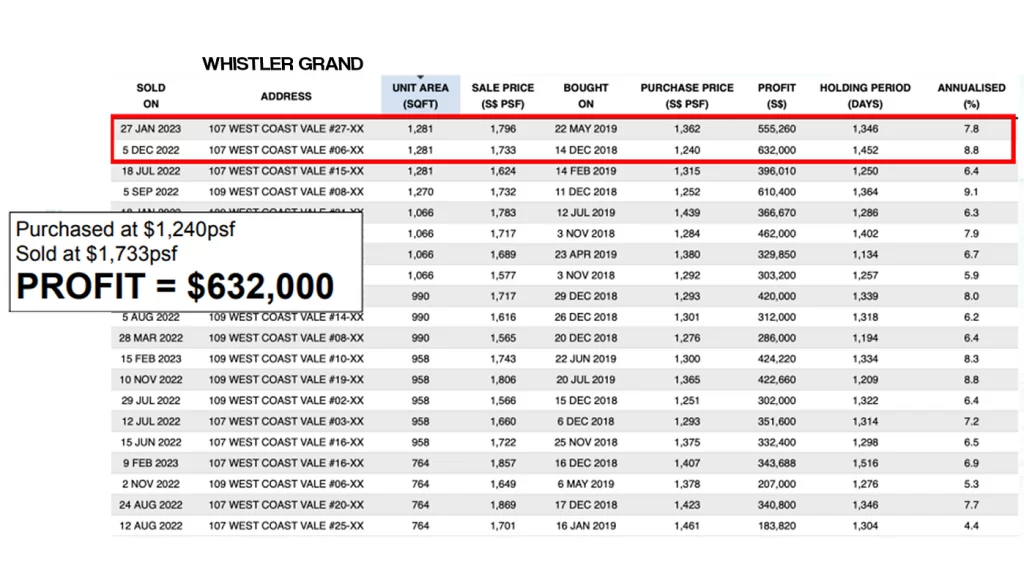

Within this case study, our objective is to conduct an in-depth analysis comparing two condominiums situated in the Western region: Parc Riviera and Whistler Grand. We will direct our attention to their respective four-bedroom units, which were acquired at a similar price per square foot (psf).

However, one of the condominiums clearly stands out as a profit-making powerhouse.

The key factor lies in their individual layouts,

which we'll explore in detail below.

On initial observation, the layouts of both condominiums may appear quite similar and practical. However, a close analysis reveals distinct disparities in the Whistler Grand unit:

Master Bedroom: Whistler Grand boasts a walk-in wardrobe in the master bedroom, introducing functionality and a touch of opulence to the living space.

Wet and Dry Kitchen: The Whistler Grand unit presents both a wet and dry kitchen, delivering convenience and orderliness for food preparation and cooking.

Yard Area: Whistler Grand incorporates a dedicated yard area for efficient laundry drying, a pragmatic feature that elevates the overall functionality of the unit.

Based on our experience, it’s clear that most 4-bedroom buyers are looking to live in the property themselves. For them, the “feel good” aspects are a big deal when deciding. They’re willing to pay a premium for a comfortable and cozy home where they can make special memories with their family.

Profit Comparison

Let’s compare the profits made from two similar 4-bedroom units:

The owner of Parc Riviera made a profit of $356,000, while the owner of Whistler Grand made a much higher profit of $632,000.

The difference in their profits is $276,000, almost twice as much as Parc Riviera’s profit.

So, why did two similar units, in the same area and built around the same time, have such different selling prices?

The answer is in how Whistler Grand’s layout. Its layout made it more attractive and practical.

This case study shows that even with similar size and location, the layout of a property can greatly affect its selling price. It’s important to choose the right layout when buying a property.

CASE STUDY 2

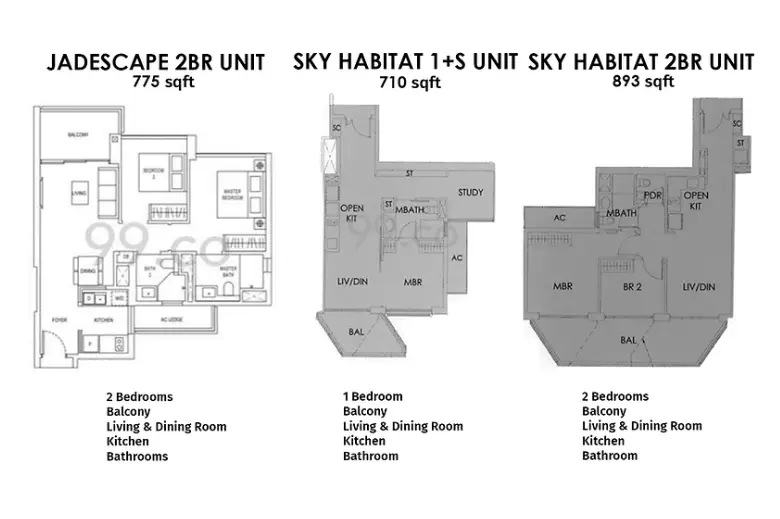

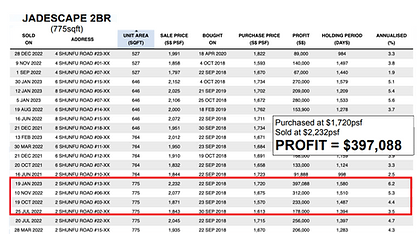

In our next case study, we shift our focus to District 20, specifically in the Bishan area, where we will analyze two well-known condominium developments: Jadescape and Sky Habitat.

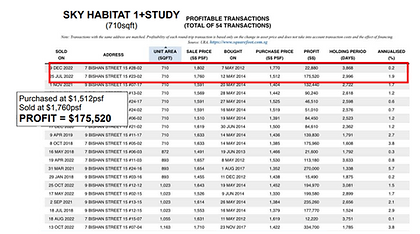

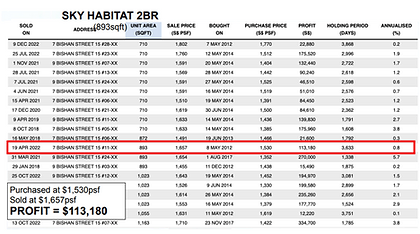

This case study will involve a comparative assessment, where we will compare a 2-bedroom unit from Jadescape with both a 1+ study and a 2-bedroom unit from Sky Habitat. Notably, these units were all acquired at a similar price per square foot (psf).

Our goal is to determine whether the layout of these units significantly affects their selling prices and, consequently, the profits they generate.

Let's see if the layouts also affect their selling prices and profits.

Upon a thorough layout analysis, a standout feature becomes apparent in the 2-bedroom unit at Jadescape: it boasts an enclosed kitchen with windows. This unique design element not only facilitates the installation of an open fire stove but also guarantees an ideal cooking space with effective ventilation.

Did you know that this is actually an uncommon feature in most 2-bedroom condos in Singapore?

Profit Comparison

Now, let’s delve into the profit comparison aspect

The difference in profit margins is quite remarkable.

The owner of the Jadescape unit made a profit of $397,088, while the owner of the Sky Habitat 1+ study unit earned $175,520, and the Sky Habitat 2-bedroom unit owner got $113,180 in profit.

Essentially, the Jadescape owner made more than twice the profit compared to the Sky Habitat owners.

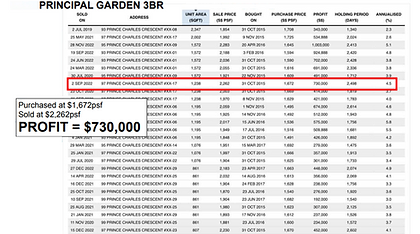

CASE STUDY 3

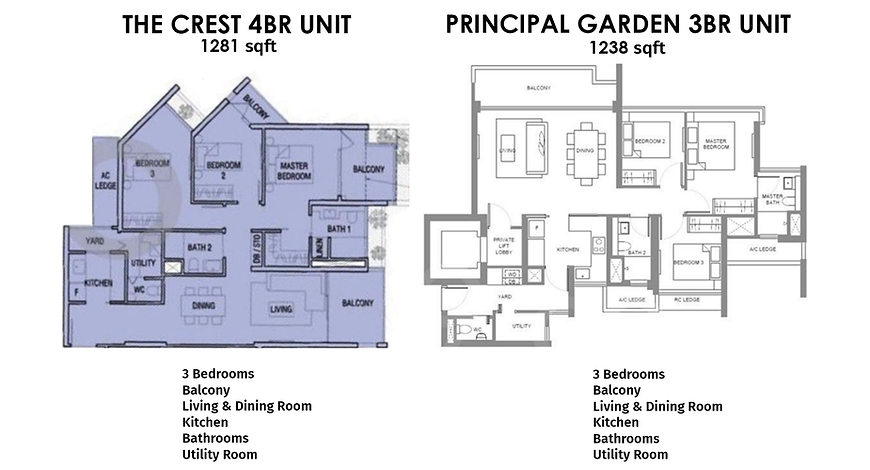

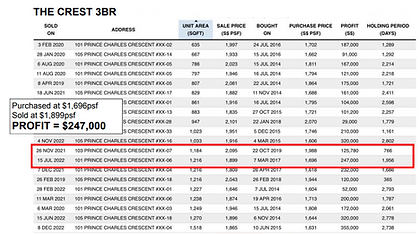

For our last case study, we’ll look at the layout of The Crest and Principal Garden, located in District 3

In this comparative analysis, our attention will be directed towards 3-bedroom units in both The Crest and Principal Garden. These two properties bear a notable similarity in terms of their location, dimensions, and unit configuration.

Will this case study mirrors the outcomes of our previous case studies?

When we examine the layouts of the two units, one significant difference stands out in The Crest. There are peculiar angular extensions in the Master Bedroom and Bedroom 2, whereas the bedrooms in Principal Garden have more conventional shapes.

The unconventional angles in The Crest’s unit limit our ability to fully utilize the bedroom space, while in the Principal Garden unit, all the bedrooms comfortably fit a queen-sized bed.

To maximize capital gains when reselling a condominium, it’s crucial to consider what prospective buyers will seek.

In suburban areas, there’s a higher likelihood of HDB upgraders, so we should understand their layout preferences. In contrast, in upscale locations like the Core Central Region (CCR), it’s important to cater to the preferences of buyers in that segment.

Profit Comparison

Now, let’s evaluate the profit comparison:

The owner of The Crest realized a profit of $247,000, while the owner of Principal Garden achieved an impressive profit of $730,000.

Yes, you read that correctly –

the owner of Principal Garden nearly tripled the profit compared to The Crest’s owner.

The substantial difference in profits between these two units, despite their similar location, size, and type, is quite remarkable. Understanding the layout preferences of potential buyers is undeniably vital, and this knowledge is a crucial part of our strategy to ensure the best possible outcomes for our clients.

In summary,

Your choice of layout is a pivotal strategy that can significantly impact your future profits, setting you apart from neighbors in the same stack, development, and area.

If you’re interested, reach out to us, and we’ll unveil the array of proven strategies we’ve employed over the years to guide our clients safely into the market and toward larger profits.

Story Time!

Back then, my friend, Ron casually mentioned his plans to invest in a new launch property, but he soon found himself overwhelmed by the options available in the market. At the time, I was relatively new to the world of new launch properties, but I decided to share some strategies that I had learned to help identify promising developments and units.

You see, even though he believed he done his homework and research, he realized he wasn’t entirely sure what to focus on, especially when dealing with substantial sums of money.

The thought of his unit losing value was nerve-wracking.

I used VARIOUS STRATEGIES and shortlisted two developments, each offering its unique opportunities. But there was a catch. His wife had a preference for one development over the other.

After all, a property isn’t just an investment; it’s a place where you and your family will build memories and create a life. So, even if the numbers favored one development, it was crucial to follow our hearts and go with what we truly loved.

So then, it was down to unit selection within this development. I used one of the strategies known as Layout Selection, a method that would help us pinpoint the ideal unit with a safe entry price and a secure exit plan for the future. It felt a little like treasure hunting, ensuring that their investment wasn’t just profitable but also well-protected.

Fast forward to today, and they’re sitting on a handsome profit compared to their neighbor in the same development. My friend became living proof that this Layout Selection Strategy worked.

He shared his experience with me, saying, “This actually works, and we should tell more people about it.”

So, here I am, sharing a few case studies about different layouts that can make a world of difference when it comes to maximizing your investment. It’s not about complicated formulas or confusing jargon, but practical strategies that anyone can use to ensure they’re making the most of their real estate investments.

If my friend’s story has taught us anything, it’s that sometimes a little guidance and a well-thought-out approach can be the key to securing your financial future.

So, why not give it a try and see how you can benefit from these strategies too? Your future profits may thank you for it.

Say Hello!

Testimonials from clients

Disclaimer: The information published is for informational purposes only. The content provided on this page does not constitute to legal, financial or professional advice. Viewers should not act upon any information provided on this page without seeking advice from a professional.

© 2023 SGCONDLAUNCHPAD

All rights reserved